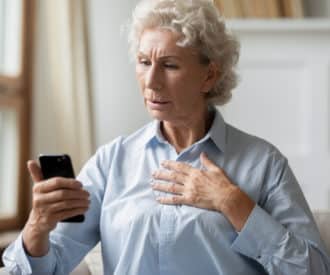

Tax season is prime time for financial scams against seniors

Tax season is the perfect opportunity for thieves looking to con older adults. Fraudsters prey on people’s fear of the IRS to steal seniors’ hard-earned savings.

We describe the most common tax season scams to avoid and recommend two trusted organizations where you can ask questions and get updates on the latest scams.

Protect seniors from these common tax season scams

Scammers pretend they’re IRS agents who are fixing problems with a tax return or working on a refund check. Many of these fraudsters are so convincing that it’s easy to fall for their lies.

According to Next Avenue, the “I’m calling to fix an error on your tax return” trick was used to scam more than 5000 people out of $50 million. That’s why it’s essential to be aware of common scams and educate seniors to be on the lookout for these thieves.

In their full article, Next Avenue shares common tax and related scams that older adults need to know about. Here’s a summary of their top warnings.

Tax scams

- Phone calls, postal mail, and email

- Reasons for contact: SSN needed to complete the return, tax bills requiring immediate payment, check the status of tax refund

- Aggressive tactics: giving fake names and fake badge numbers, threatening people with arrest unless immediate payment is made

Healthcare scam

- IRS email or social media contact

- A fake IRS “CP2000” notice is used to request immediate payment for Affordable Care Act taxes

Know what real IRS agents will never do

This important announcement is directly from the IRS website (here):

“The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. In addition, IRS does not threaten taxpayers with lawsuits, imprisonment or other enforcement action. Recognizing these telltale signs of a phishing or tax scam could save you from becoming a victim.”

Check trusted sources for the latest on scams

If you have any concerns about your older adult’s tax return or think a scammer might be contacting them, there are two safe sources where you can get more information.

The IRS posts information about the latest scams here on their website. If you have questions about an IRS notice, call them at 1-800-829-1040. Additional IRS contact information is posted here.

TurboTax also posts up-to-date information about scams here on their website. If you have questions about potentially fraudulent communication, email them at spoof@intuit.com

Bottom line

Educate yourself about these common financial scams against seniors. Then, share the information with your older adult. Knowing about the dirty tricks that fraudsters are using is the first step in defending their savings.

Next Step Find out more about the most common tax season scams at Next Avenue

Recommended for you:

- 3 Top Senior Scams to Watch Out For: Advice From the FBI

- 5 Ways to Reduce Resistance When Helping Aging Parents with Finances

- Get Rid of Junk Mail to Prevent Elder Fraud

By DailyCaring Editorial Team

Image: Sunday Post

This article wasn’t sponsored and doesn’t contain affiliate links. For more information, see How We Make Money.