When seniors are considering a move, one important factor to consider is the state taxes. Before making a decision, take a look at the best and worst states for seniors to live in, based on taxes, shared by SeniorLiving.org Research.

For many caregivers, 2021 is a time to consider whether they, or the family member(s) they care for, should move closer to one another.

A move could also be due to retirement, downsizing, a warmer climate, or other timely factors like COVID-19, among other reasons.

It’s important to make an informed decision when thinking about a move, and state taxes can and should be a consideration, as they can impact a person’s finances quite a bit through income, sales, property, or even grocery taxes.

We took a look at taxes by state to determine the best – and worst – places to live tax-wise.

Here are the steps we recommend you take before making a decision about a move for you or your loved one.

1. Understand Tax Burden and the State Taxes that Affect Older Adults

A state's tax burden is the percentage of total income that residents pay on state and local taxes.

For example, personal finance website, WalletHub, considered property, income, and sales and excise taxes when assessing each state's tax burden in 2020.

New York had the highest tax burden at 12.28%. Smack dab in the middle at number 25 was Pennsylvania at 8.53%.

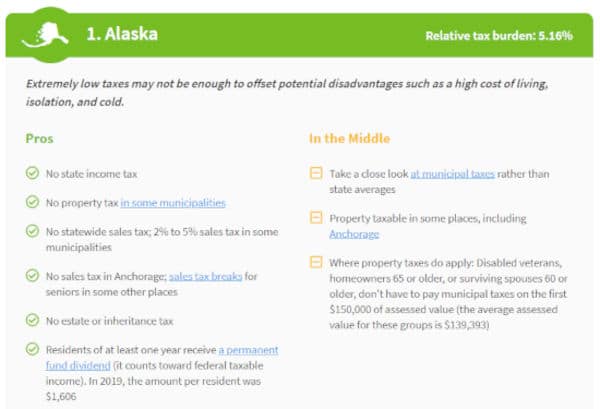

Which state has the lowest tax burden? If you guessed Alaska, you’re right on the money – residents pay just 5.16% of their income on state and local taxes.

It’s important to consider, however, that older adults are a diverse, varied group – they could be working or retired, in their 50s or in their 80s.

Adding to the mix, a state's tax burden tends to be more relevant to younger, working adults. It might not reflect how tax-friendly a state is to retired adults.

For example, some states give older, lower-income, or retired adults breaks on property tax or don't impose a tax on Social Security income.

So, it's good to consider both a state’s general tax burden and also how a state taxes retirees, or you might say, its “tax friendliness” toward retirees.

Kiplinger has a nice breakdown on the latter with factors such as Social Security, estate, property, and sales taxes.

2. Speaking of “Tax Friendliness”… Here are the Critical Taxes You Need to Consider

Property: The largest contributor to state and local coffers at 31.9 percent, according to the Tax Foundation. Most states have property tax relief programs for income- and age-eligible adults.

Sales: Taxes on goods and services, at 23.6 percent, are a significant source of revenue. Many municipalities have both a local and state sales tax. Alabama, Mississippi, and South Dakota apply the full sales tax rate on groceries, which can hurt older adults.

Income: Based on earned wages, Social Security benefits, retirement plan withdrawals, and other types of income. At 23.3 percent of revenue, income taxes bring in just a little less money than state taxes do.

Estate taxes: Taxes that a deceased person's estate pays based on its net value before the estate passes on to heirs. Twelve states and D.C. tax estates above a certain value (there's a federal tax, too). Estate planning attorneys can help solder adults preserve as many assets as possible for their heirs.

Inheritance tax: Taxes that heirs must pay in six states. Spouses are exempt. So are many direct ascendants and descendants.

3. Examine and Appraise the Least Expensive States

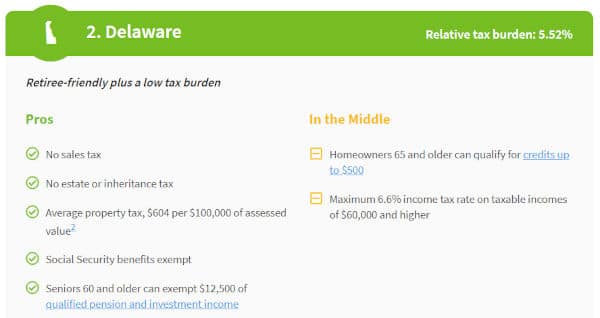

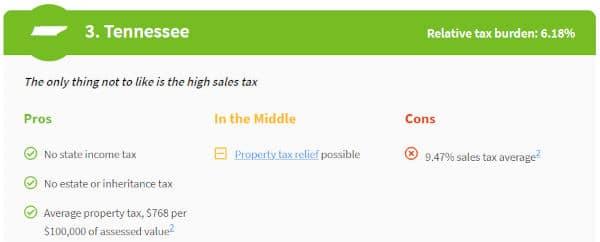

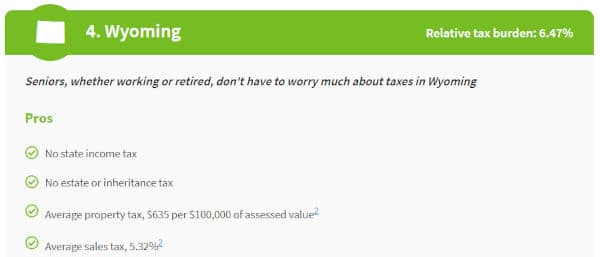

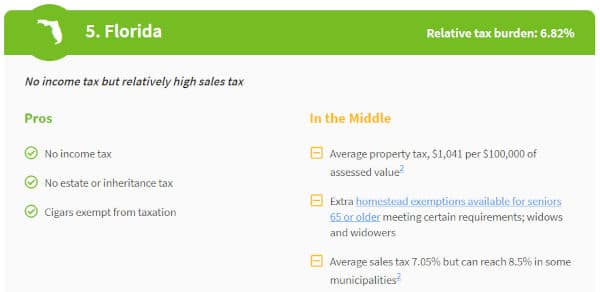

Without further ado, here’s a look at the all-star, least expensive 10 states for older adults and retirees tax-wise, arranged from the lowest tax burden to the highest.

Coming in close behind the top-five affordable states for older adults are:

#6 – New Hampshire (6.85%) – No income or sales tax, but property taxes are high.

#7 – Alabama (7.36%) – Tax-friendly except for high sales tax.

#8 – South Carolina (7.48%) – Retiree-friendly state with low tax burden and graduated income tax.

#9 – South Dakota (7.86%) – No income tax but groceries can get expensive.

#10 – Georgia (7.98%) – Lots of retirement income exempt from taxation.

4. Be Informed About the Most Expensive States

On the other end of the scale, the most expensive states for older adults tax-wise, by relative tax burden percentage, are:

#1 – New York (12.28%) – Thankfully, the high tax burden decreases after retirement.

#2 – Vermont (10.73%) – Cold winters, and a cold tax climate for many older adults.

#3 – Minnesota (10.19%) – Includes tax on Social Security income.

#4 – Connecticut (9.99%) – Higher-income retirees may not like the picture in Connecticut.

#5 – Rhode Island (9.84%) – Also not friendly toward higher-income retirees.

#6 – Wisconsin (9.12%) – Homeowners pay a lot in property taxes.

#7 – Nebraska (9.1%) – Kiplinger calls it the least tax-friendly state for retirees.

#8 – Kansas (8.33%) – Lower-income adults get some breaks but still contend with a high sales tax.

#9 – New Mexico – (8.74%) – Residents must live to 100 to skip income taxes.

Whether you or your loved one live to be a centenarian or not, as you can see, taxes by state vary considerably.

Even within the same state, they can diverge quite a bit based on factors such as income tax rates and whether Social Security payments are taxed.

For the full state-by-state tax comparison, go to: https://www.seniorliving.org/finance/state-taxes-seniors/.

Recommended for you:

- Cost of Long Term Care: 5 Ways Estimates Help Seniors and Caregivers

- Financial Help for Seniors: 2,500+ Federal, State, & Private Benefits Programs

- How to Help Aging Parents with Finances: Getting Started Guide

Guest contributor: Jeff Hoyt, Editor-in-Chief, SeniorLiving.org Research. SeniorLiving.org is where older adults and their loved ones can find and compare housing options, including assisted living, in-home care, and everything in-between. We publish research on issues facing aging, and cover governmental programs, economic and social issues.