Navigating the alphabet soup of senior healthcare (Medicare, Medicaid, Medigap) can feel like deciphering a complex code. Two names cause the most confusion: Medicare and Medicaid. They sound similar, but confusing them can lead to costly coverage gaps and denied claims when you can least afford it.

One is an earned federal benefit for seniors, while the other is a state-based financial assistance program for those with limited income and resources. Understanding the key differences between Medicare and Medicaid isn't just about paperwork; it's about ensuring your loved one receives the healthcare coverage they're entitled to, protects their life savings, and maintains access to essential long-term care.

Let's break down exactly what each program is, who qualifies, what they cover, and—most importantly—how they can work together.

Understand Medicare vs. Medicaid to Get Maximum Benefits

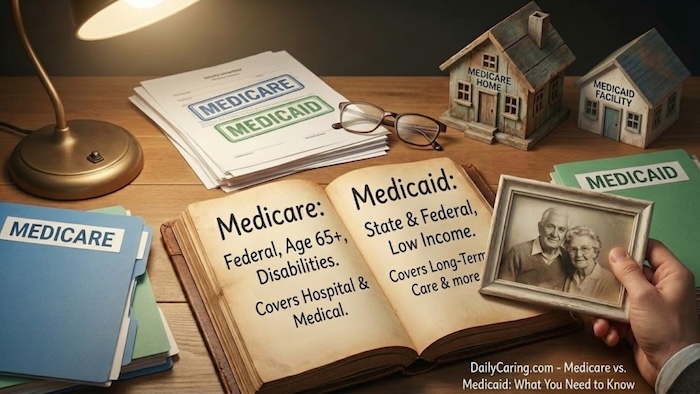

Medicare and Medicaid can be confusing, partly because the names sound so similar.

But they’re two very different government healthcare programs.

Medicare focuses on adults age 65 and older, and Medicaid focuses on low-income individuals and families. The benefits, costs, and eligibility requirements vary by program.

Neither program has automatic enrollment, so it’s essential to understand what each one offers.

Knowing which to apply for helps maximize your older adult’s healthcare benefits.

We explain the two key differences between Medicare and Medicaid, share five essential facts about each program, and explain what’s covered when people are eligible for both Medicare and Medicaid.

Medicare vs. Medicaid: 2 key differences

The first and most significant difference between Medicare and Medicaid is eligibility.

Because of the different eligibility rules, some people who qualify for Medicaid won't be eligible for Medicare, and vice versa.

The second key difference is that Medicaid covers long-term care services and support. In fact, Medicaid is the nation's largest single source of long-term care funding.

If medically necessary, Medicaid can cover the cost of nursing homes, assisted living communities, and other long-term care options.

Generally, Medicare only covers short term stays in skilled nursing facilities after a hospitalization.

5 Essential Medicare Facts You Need to Know

1. What is Medicare?

Medicare is an insurance program available to U.S. citizens aged 65 and older, regardless of income.

If Medicare covers someone, their medical bills are paid from trust funds funded by Medicare payroll taxes.

2. Who qualifies for Medicare?

Anyone age 65 or older with a qualifying work history (their own or their spouse’s) is eligible for Medicare.

Most people who’ve worked for 10 years at a job in which they paid Medicare taxes will qualify. Younger people with specific disabilities or end-stage renal disease may also be eligible.

3. Who runs Medicare?

The federal government.

4. What does Medicare cover?

Medicare is available through a 4-part program. The coverage depends on the plans selected.

The 4-part program includes:

- Part A: Hospitalization – inpatient care and services received at a hospital or skilled nursing facility

- Part B: Medical insurance – outpatient doctor visits, care, and services and some preventive care

- Part C: Medicare Advantage plans – privately purchased supplemental insurance with additional services, and often combine Part A, Part B, and Part D into one plan

- Part D: Prescription drugs

5. How much does Medicare cost?

The cost of Medicare depends on the chosen plans and coverage. Costs typically include premiums, deductibles, copays, and coinsurance.

The premium for Part A is free for individuals or their spouses who have worked at least 10 years and paid Medicare payroll taxes during their employment.

Most people pay a Part B premium.

Costs for Parts C and D will depend on the plan chosen.

5 Essential Medicaid Facts You Need to Know

1. What is Medicaid?

Medicaid is a health insurance program that serves low-income people of all ages. It helps cover medical and long-term care costs.

People covered by Medicaid usually pay nothing for covered medical expenses.

2. Who qualifies for Medicaid?

Medicaid has strict eligibility requirements based on income and financial resources, so not everyone can qualify.

Generally, a wide variety of people with limited income and financial resources can qualify.

That includes those who are 65 or older, living with a disability, children under 19, parents or other adults caring for a child, and some adults without dependent children.

Medicaid.gov and BenefitsCheckUp.org have more information about state-by-state eligibility requirements.

3. Who runs Medicaid?

Both federal and state governments run Medicaid within federal guidelines.

Because of this federal-state partnership, Medicaid programs vary by state.

That’s why people who are eligible for Medicaid in one state might not qualify in another. The types of covered medical services may vary by state.

4. What does Medicaid cover?

Medicaid services vary by state, but federal guidelines require coverage of specific “medically necessary” services.

Benefits typically include:

- Care and services received in a hospital or skilled nursing facility

- Care and services received in a federally-qualified health center or rural health clinic

- Doctor and nursing services

- Long-term care

- Home health care for people eligible for nursing facility services

- Laboratory services and X-rays

- Medical and surgical dental services

Some states may include additional benefits such as prescription drug coverage, optometry services, eyeglasses, medical transportation, physical therapy, prosthetic devices, and dental services. If included, people covered by Medicaid pay nothing for these covered services.

Some Medicaid benefits overlap with Medicare, such as hospital care and physician services. But Medicaid may also offer benefits not covered under Original Medicare, such as personal care, optometry, and dental services.

Additionally, available providers (such as hospitals and doctors) under Medicaid are often different from those available to people using Medicare.

5. How much does Medicaid cost?

Medicaid costs depend on income and the rules of the state’s program. Certain people may be exempt from most out-of-pocket costs.

Costs may include premiums, deductibles, copays, and coinsurance.

Dual eligibility: qualifying for both Medicare and Medicaid

People who qualify for both Medicaid and Medicare Part A and/or Part B are known as “dual eligible.”

When someone is dual eligible, Medicaid will pay for Medicare costs under four types of Medicare Savings Programs. The amount that Medicaid covers depends on income level.

For example, if someone has both Medicare and full Medicaid coverage, their health care costs are usually fully covered, including prescription drugs, so they won’t have to pay out-of-pocket.

Final Thoughts About Medicare vs Medicaid

Demystifying Medicare and Medicaid transforms them from sources of confusion into powerful tools for securing comprehensive care. Remember: Medicare is health insurance you've paid into, primarily covering hospital and doctor visits for those 65+. Medicaid is a safety net based on financial need and the primary public payer for long-term custodial care, such as nursing homes.

For many seniors, the key to covering all bases is dual eligibility, using both programs in tandem. Don't let the complexity paralyze you. Use this knowledge as your starting point to ask the right questions, seek help from a SHIP counselor or elder law attorney, and create a solid plan. Getting this right means peace of mind, protected assets, and the assurance that your loved one will have access to the medical and supportive care they need through every stage of aging.

Recommended for you:

- 5 Medicaid Misconceptions Caregivers Need to Know About

- Get Medicare Advice From State Counseling Programs

- Get the Truth Behind 5 Common Medicare Myths

About the Author

Connie is the founder of DailyCaring.com and was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also understands the importance of support, especially in the form of practical solutions, valuable resources, and self-care tips.

I want to know what organizations pay the caregiver to take care of people who are homeless, sick, disabled?

There are some government programs that pay family caregivers. We’ve got an article about it here – How to Get Paid by the State for Taking Care of Someone: 3 Benefits Programs at https://dailycaring.com/getting-paid-as-a-family-caregiver-3-government-benefits-programs/

I’m taking care my husband who is 78 years. He has Dementia who keep him being able to talk, walk , perform task and loss memory. I would like to keep him at home as long as I can. I would like to know if there are any way of support that I can get with finances. I am 70 years. I would like to hear from you. Thank you

We’ve got a few articles with more information about financial assistance:

– Getting Paid as a Family Caregiver: 3 Government Benefits Programs https://dailycaring.com/getting-paid-as-a-family-caregiver-3-government-benefits-programs/

– Financial Help for Seniors: 2,500+ Federal, State, & Private Benefits Programs https://dailycaring.com/find-financial-help-for-seniors-federal-state-and-private-benefits-programs/

– 4 Financial Assistance Programs for Seniors and Family Caregivers https://dailycaring.com/financial-assistance-programs-seniors-caregivers/

This is all a lot of help, but I am on regular Medicare and wonder if I can get the advantage plan also. I could use the help with hearing aids & dental expense. I am thinking I might be eligible for Medicaid but not sure. Can I get help at a Medicare office or other person.

We aren’t Medicare experts, so we can’t answer this question, but you may want to contact Medicare counselors at a state run program to learn about your options.

Get more info on that program here – Get Help with Medicare Questions from State Programs https://dailycaring.com/get-help-with-medicare-questions-from-state-programs/

Would my father who is 91 be eligible for both Medicare and Medicaid? How can I apply for both for him? My mother is deceased and he only receives Social Security monthly. We do not want to place him in a nursing home and wish to keep him at home as long as we can. He is currently on Medicaid Advantage. I will also call the number on his Medicaid Advantage card but will wait to hear from you. Thank you

To find out if your father qualifies for both Medicaid and Medicare, check Medicaid.gov and BenefitsCheckUp.org to get more information about his state’s eligibility requirements.

For advice specific to his situation, you may also want to contact the local SHIP (State Health Insurance and Assistance Programs) office. These are state-run counseling programs are available so you can get help with Medicare questions for free.

Get more info and contact info for SHIP offices in this article – Get Help with Medicare Questions from State Programs https://dailycaring.com/get-help-with-medicare-questions-from-state-programs/

I’m taking care of my sister who is 78 yrs she has parkison which keeps her from being able to move its a great strain on me. I would like to know if there are any means of support that I can get with finances. please respond. Thank You

It’s wonderful that you’re able to care for your sister.

Family caregivers may be eligible to be paid for caregiving through government programs. Get more info on them here — 3 Ways of Getting Paid as a Family Caregiver: Government Benefits Programs https://dailycaring.com/3-ways-of-getting-paid-as-a-family-caregiver-government-benefits-programs/

Your local Area Agency on Aging may be able to connect you to other local organizations who can provide help. More info here — Local Community Resources for Seniors and Caregivers: Area Agency on Aging https://dailycaring.com/local-community-resources-for-seniors-and-caregivers-area-agency-on-aging/

You may also be eligible for government assistance programs that help pay for household and caregiving costs. More info here — Benefits Programs Help Pay for Caregiving Expenses https://dailycaring.com/financial-help-caregiving-expenses/

There’s been stipulations about Medicare covering Homecare Services probably in 2019. Can readers get a status on this as soon as the facts are available?

There was a change in the law that will allow Medicare Advantage plans to offer additional benefits including adult day care programs, home aides to help with activities of daily living like bathing and dressing, palliative care at home for some patients, home safety devices and modifications like grab bars and wheelchair ramps, and transportation to medical appointments. What actually will or won’t be offered will be up to individual insurers so the only way to know is to review their 2019 plans.

Here’s some additional info that may be helpful — https://www.nytimes.com/2018/07/20/health/medicare-advantage-benefits.html

I think Medicare NEEDS to cover 100% of ALL medical costs INSTEAD of 80/20%!!! There s to many PLANS(Part A;B/&D) & nobody knows What Plan covers What;It Needs to b made simpler!!!!

We understand how you feel. Medical bills are a major challenge for most families and the Medicare & Medicaid systems certainly need to be improved and made easier to understand 🙁