Cost is a major factor in long term care decisions

Paying for senior care is a major source of stress for family caregivers, often because costs can spring up suddenly.

As your older adult needs more and more help, you’ll probably need to choose between different long term care options, like hiring in-home care vs moving to assisted living or moving from one city to another.

A key part of those decisions will be based on how much their care will cost. Get a head start and avoid unpleasant surprises by estimating future costs now.

To make it easier, we found a quick, easy, and free online tool that calculates and compares the costs of long term care options.

We explain how to use it and how to estimate and compare costs into the future and across different cities.

Free online tool estimates and compares long term care costs

Genworth created an online tool that compares costs for long term care options. It’s completely free to use and doesn’t require any sign-up.

The estimated numbers help you get a ballpark idea – they won’t be exactly the same as specific facilities or services in your older adult’s area.

These estimates help you narrow down the options to those that will be the most reasonable for your older adult’s financial situation.

Estimating and planning ahead also gives you time to explore different ways to pay for care or get help from an elder law attorney for things like a Medicaid spend down strategy.

How to use the tool to estimate long term care costs

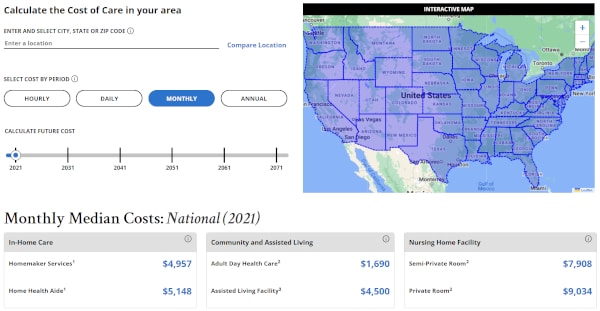

To give you a basic idea of long term care costs, the 2021 national median (average) monthly costs for in-home care, assisted living, and nursing homes are shown below the tool.

Genworth’s online long term care cost estimator tool and national monthly average costs

To estimate costs for your older adult’s state:

- Click here to get to Genworth’s online tool

- Enter and select a City, State, or Zip Code (upper left) or click a state on the interactive U.S. map (upper right)

- Choose the time period for the costs: hourly, daily, monthly, or annual

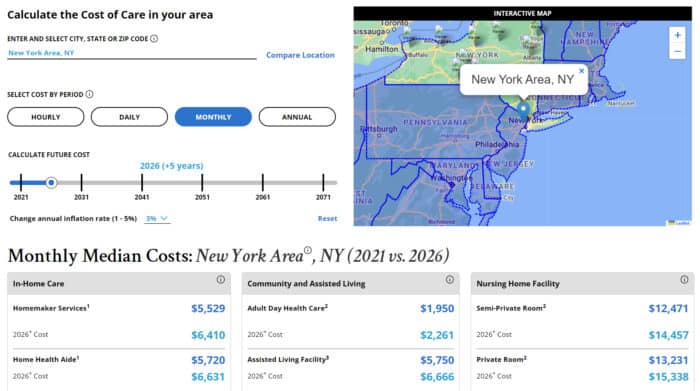

If you want to get an idea of what the costs will be like in the future, use the Calculate Future Cost slider bar.

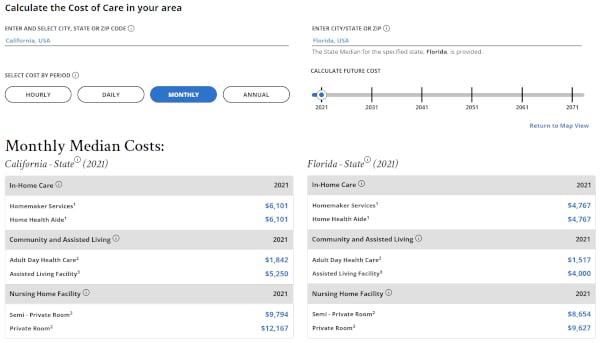

To compare costs between different cities or states, choose the “Compare Location” link in the upper middle area to add another location.

You can also adjust the number of in-home care hours per week by clicking on the Plus sign below the cost estimator tool labeled “Change weekly In-Home Care hours.”

Here, we show some examples:

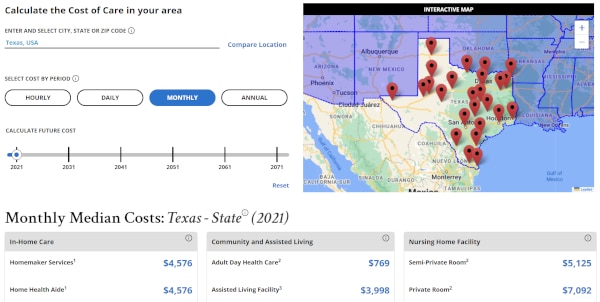

Average monthly long term care costs in Texas

Comparing 2021 and 2026 costs in New York

Comparing 2021 costs in California and Florida

Use estimates to make realistic plans for the future

To plan for your older adult’s future, it helps to ask some key questions:

- How is their overall health?

- Will they be living with or near someone who can provide some care? Or will they need full- or part-time hired caregiving help?

- Do they enjoy socializing with others their age? Or would they prefer to stay at home and see mostly family?

- What types of care work best with their needs and budget?

Answering those questions will help you figure out if in-home care or adult day programs will work or if assisted living or a nursing home would be better options.

Next Step Quickly estimate your older adult’s long term care costs using Genworth’s free, easy-to-use tool

Recommended for you:

- Financial Help for Seniors: 2,500+ Federal, State, & Private Benefits Programs

- The Ultimate Guide to Senior Veterans Benefits

- Cost of Long Term Care: 5 Ways Estimates Help Seniors and Caregivers

By DailyCaring Editorial Team

This article wasn’t sponsored and doesn’t contain affiliate links. For more information, see How We Make Money.

[optin-monster slug=”yxbytm35zhsdfopnw7qk”][optin-monster slug=”jvhyplxmb4umsjazxecn”]

About the Author

Connie Chow

Connie was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also knows how important support is — especially in the form of practical solutions, valuable resources, and self-care tips.

I agree wholeheartedly with the person that wrote in. No one cares. They, the nursing homes, lawyers, Medicare S. W. want you to empty out your savings, sell your house, cars. Things we BOTH worked hard for. We both grew up poor and felt wonderful buying our own house. We have a tiny bit saved. Now this. I even read one article on one nursing homes web site to get a reverse mortgage. Ridiculous. Political people are in it for the money not to help people afford this. And yes life care insurance is only for 2 or 5 years. My mother was in a nursing home back in the day for 15 years. She did not get proper care. We moved her twice. I’d clean out her room. Bring her clothes home to wash. The ones that didn’t get stolen. Her wedding rings and watch were stolen the first day, gone by time I remembered them and went back to get them.

Sadly, the system in this country isn’t set up for long term care. Until that changes, we’re stuck with the programs that are available, which don’t provide the best options for everyone.

Very interesting but not helpful or relevant to those of us with fixed incomes well below $5,000 per month!

With cost of Assisted Living in Tucson averaging $4,000 per month, and income of $2805.00 per month there is no point in doing any calculations! Social Security goes up at most, 1.5% per year. But – Medicare payments go far higher and so, for example this year, my Social Security, after deduction of Medicare, is just $641. My husbands went from $1441 to $1458! He gets 1/2 of his pension and a small pittance from the state of AZ = 2805.

For many of us, (wish someone would do a survey to learn just how many of us) on fixed incomes, if we have no family, we are faced with caregiving with no assistance. Some have insurance that will pay a small amount for a limited time, but not what, for example, is needed when one of the couple have Alzheimer’s requiring assistance with personal care, 24/7. The spouse without this damn disease is faced with not only their own health issues, but with constant care of their loved one, no help and whatever savings they may have, gone. Yes, many states do have a form of Medicaid Long Term Care, but the requirements are many and very harsh. For the spouse who is not eligible for the program – they may not have qualifying health issues – they end up with a small amount of money to try to live on while being separated from the loved one. That alone is a hardship for most of us. My husband and I have never been separated and we have no intention of ever being so until one of us dies. In the richest country in the world, Senior citizens are left behind. If only we have moved to Canada in 2008!

Everyone has a different financial situation and we’re sorry that this article doesn’t apply to yours. In case it’s helpful, we’ve got two articles about financial assistance:

– Financial Help for Seniors: 2,500+ Federal, State, & Private Benefits Programs https://dailycaring.com/find-financial-help-for-seniors-federal-state-and-private-benefits-programs/

– Getting Paid as a Family Caregiver: 3 Government Benefits Programs https://dailycaring.com/getting-paid-as-a-family-caregiver-3-government-benefits-programs/