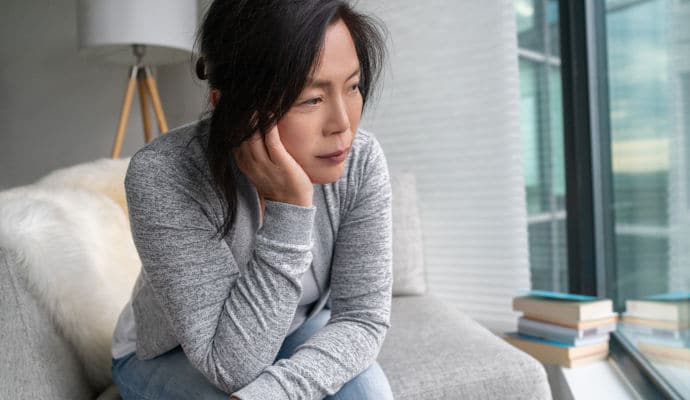

Juggling a career and being a primary caregiver can feel exhausting and unsustainable. Before deciding to quit your job to take care of an aging parent full time, assess your financial situation by asking these 7 important questions from LendingTree.

The demands of providing care for a parent or loved one can be steep.

As illness or aging progresses, many people find themselves wondering whether they should quit their jobs to become full-time caregivers for the ones they love.

Trying to juggle a job and caring for a family member can be exhausting and at times may feel impossible.

According to a study by AARP, 15% of caregivers cut back on their work hours and 14% take a leave of absence.

If you’re considering leaving work to become a full-time caregiver, it’s important to take an honest look at your situation first.

Not only do you need to examine whether you’re equipped to provide your loved one with the care they need, but you also need to determine if your financial situation is strong enough to make the change.

Before transitioning to full-time caregiving, ask yourself these seven financial questions.

1. Are my personal finances strong enough?

It’s imperative to examine your personal finances to see if they can support you while you care for a loved one. Above all, be honest about your situation.

Trying to manage caregiving responsibilities on a smaller income may not be feasible.

If you’re earning minimum wage (or close to that amount), it may already be difficult to afford housing. A recent study found that full-time minimum wage workers cannot technically afford to rent or own a home in any state in the U.S.

Another factor to consider is how long your loved one may need care.

Since you won’t know the answer to this question in advance, it’s important to err on the side of caution. Older adults who need full-time care require support for 3.9 years on average, according to the Bipartisan Policy Center.

Yet for many others, long-term care needs extend for a much longer period of time.

Cameron Huddleston, former caregiver and Director of Education for Carefull (a digital service built to protect aging adults’ daily finances), cared for her mother for more than 10 years after she was diagnosed with Alzheimer’s disease at the age of 65.

“Because it's hard to know how long your loved one will need care, you need to be prepared financially to provide care for many years,” Huddleston says. “If you can't afford to stop working for pay for even one year, you're not prepared financially to be a full-time caregiver.”

2. Is my retirement secure?

Another factor you should contemplate before leaving your job is how being a full-time caregiver may affect your own retirement plans.

If you quit working and stop saving for retirement, it could jeopardize your future financial stability.

When you have children of your own, the situation can be more complex. Huddleston strongly discourages anyone from putting their financial well-being at risk to care for a loved one, especially if they have their own children who are relying on them for support.

“I know that most people would prefer to have family care for them. And I know that most adult children feel it is their responsibility to help care for aging parents. However … if you jeopardize your finances to care for a parent, you'll continue the cycle. You'll likely have to rely on your children for support as you age and hurt their financial well-being.”

3. Have I saved enough in my emergency fund?

In order to protect your financial well-being in the face of unexpected expenses, illnesses, job loss and more, it’s critical to have an emergency fund.

Ideally, you should tuck back a minimum of six month’s worth of expenses in an account to prepare for the unexpected.

As a caregiver, you should also factor in your loved one’s monthly expenses, so it’s likely you’ll need even more stashed away.

4. Is my cash flow strong?

To be a full-time caregiver, you need a source of money to cover expenses on a monthly basis.

Huddleston recommends that you have at least one of the following means of financial support in place before you consider leaving your job:

- Cash reserves

- Another source of income

- A partner or spouse who is working and willing to support your household

- Payment from the loved one to whom you’re providing care

5. Do I have the financial resources to help care for my relative?

Before you commit to leaving your job, you should take the time to work out a sample budget.

List your existing household expenses along with any new expenses you anticipate (as much as possible).

Some options that might help you reduce expenses (or maintain your income) include:

- Moving your loved one in with you

- Asking your employer if you can work from home

- Requesting financial support from other family members

6. What will I have to give up if I leave the workforce?

In addition to giving up income if you stop working, you may miss out on other benefits as well.

On top of the loss of access to workplace retirement benefits, you may also lose medical and dental coverage.

Career goals take a backseat when you’re a full-time caregiver. But if you plan to reenter the workforce at a later date, you might find that you’re at a competitive disadvantage.

Getting rehired can sometimes be difficult after a long lapse of unemployment as data shows us you may have a 45% lower chance of getting a call for a job interview compared to those without a gap.

Plus, this may impact your opportunities for future career advancement upon getting hired.

7. Are there other options?

Rather than leaving work to become a full-time caregiver, you may want to consider whether another option would be best for you and your loved ones.

Possible alternatives include:

Adult day care

Adult day care costs around $1,603 per month, according to the Cost of Care Survey by Genworth.

Since the average Social Security benefit is $1,543 per month, you might be able to afford daytime care for your loved one that allows you to remain in the workforce.

Medicaid

Medicaid, available to those with limited assets and income, can cover the cost of long-term care in a nursing facility for your loved one.

In some states, it may provide in-home care coverage or even financial benefits to family members who serve as full-time caregivers.

Asking for support

Asking for support from others could make caring for your loved one more manageable.

Family members (siblings, grandchildren, etc.) might be able to help provide care or financial support.

Your loved one’s place of worship might be willing to ask for volunteers to relieve you for a few hours each week.

Providing full-time care for a parent or family member in need can be an incredible gesture of love. At the same time, you shouldn’t feel guilty asking for support and using caregiving services if leaving work isn’t an affordable option for you.

“Don't feel like you have failed your loved one by getting outside support,” says Huddleston. “It's imperative that you get help to preserve your own well-being. Otherwise, your own health could suffer, and you won't be able to continue to care for your loved one.”

Recommended for you:

- Getting Paid as a Family Caregiver: 3 Government Benefits Programs

- 4 Post-Pandemic Senior Care Budget Tips for Caregivers

- Financial Help for Seniors: 2,500+ Federal, State, & Private Benefits Programs

Guest contributor: Callie McGill is a content manager at LendingTree. Covering an array of personal finance topics, she works hard to provide unique viewpoints that empower people to make their best financial decisions. Callie earned her B.A. from Penn State University and her work has been published on major networks like Yahoo! and MSN.

This article wasn’t sponsored and doesn’t contain affiliate links. For more information, see How We Make Money.

[optin-monster slug=”yxbytm35zhsdfopnw7qk”][optin-monster slug=”jvhyplxmb4umsjazxecn”]