Having a joint bank account with an aging parent or loved one you’re caring for might seem ideal. After all, it can make it easier to handle daily money matters for your loved one.

Of course, nothing is ever as simple as it might seem when it comes to caregiving. Joint bank accounts are no exception.

There are pros to having a joint bank account with parents if you’re helping with or overseeing their finances. There also are cons.

That is why it’s important not to rush to the bank to open a joint account. There are other options that might be a better fit for your family’s situation.

What is a joint bank account?

If you and a parent have a joint bank account, that means you both are owners of the account.

Your parent could add you as a joint owner to an existing account or you could open a new account together.

Regardless of the approach you use, you both will have full access to the cash in the account.

The pros and cons of joint bank accounts

Having a joint bank account with a parent can make things easier for you if you are your parent’s financial caregiver.

But there are risks associated with joint accounts.

Pros

- You can easily monitor transactions and account balances to protect your parent’s financial well-being.

- You can deposit or withdraw cash as needed to pay for your parent’s expenses.

- You can act as a second set of eyes to catch unusual transactions and potential fraud.

- You’ll have immediate access to the cash at the time of your parent’s death without having to go through the probate process. Those funds could be used to pay for final expenses.

Cons

- You could put your parent’s money at risk if you have financial problems. Creditors can take funds from the joint account to settle your debts.

- Assets in the joint account could affect college financial aid eligibility for any children you have.

- Your parent’s eligibility for Medicaid to cover long-term care costs could be impacted if you’re making withdrawals from the account. Those withdrawals could be considered a transfer of assets from your parent to you, which could make your parent ineligible for Medicaid for a certain period of time.

- There could be tax complications of having a joint account. If the account earns interest, you’ll have to report the interest earned on your own federal income tax return, as well as on your parent’s tax return. Joint accounts also can have gift tax implications if the co-owners aren’t spouses.

- All the money in the joint account will belong to you after your parent’s death, which could create problems if you have siblings.

When having a joint account does and doesn’t make sense

Having a joint bank account with a parent can be convenient, but it usually isn’t the ideal approach to helping your parent with money matters.

If you have siblings, it easily could lead to disputes.

They might assume you are using your parent’s money for your own benefit if you aren’t carefully documenting how the money is being spent. Or they might assume you’ll keep everything for yourself once your parent passes away.

So when there is more than one child, a joint account can create more problems than it solves.

A joint account could make sense if you are an only child and your parent wants you to take an active role in his or her daily money matters.

You also must be committed to using the money in the account for your parent’s best interest, not yours.

A safer alternative to joint bank accounts

As mentioned above, one of the biggest pros of a joint bank account is that it allows you to monitor and protect your parent’s finances.

The good news is that there is secure technology that offers that same benefit without the drawbacks of a joint account: Carefull.

Carefull is the first service built to organize and protect aging adults’ daily finances.

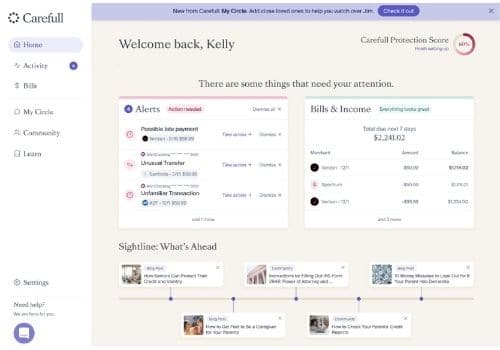

You can link your parent’s bank and credit card accounts to the Carefull app or desktop service so you can see their money accounts in one place.

Your Carefull dashboard

Carefull also monitors those accounts 24/7 for issues that commonly affect an older adult’s finances.

The service looks for more than 30 red flags that could be simple mistakes that need to be addressed before they become big problems or suspicious activity that could be a sign of fraud.

Carefull checks for 30+ red flags, including:

- Late or missed payments

- Duplicate payments

- Changes in spending

- Insufficient funds to cover upcoming bills

- Unfamiliar transactions

- Purchases at unfamiliar merchants

- Recurring charitable or political contributions

- Changes in pharmacy spending

- And much more

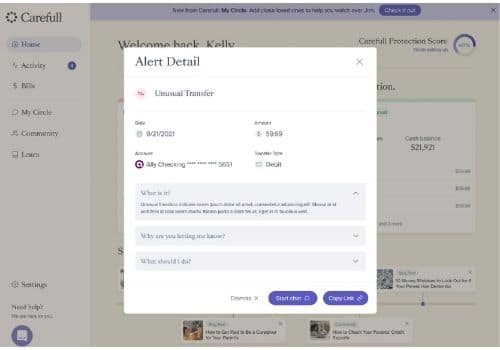

Example of a Carefull suspicious activity alert

If Carefull spots anything unusual, it will send alerts by text and email so you’ll know right away if something is wrong.

Carefull also monitors the Internet for misuse of your loved one’s credit and personal information and sends alerts so you can act quickly to stop scammers.

To protect against the downsides of a joint bank account Carefull allows you to have view only access to their accounts.

This way you can see what is going on in your loved one’s accounts, but you can’t make transactions within those accounts.

No mingling of assets – just peace of mind knowing your loved one’s money is safe while allowing your aging parent to remain independent for as long as possible.

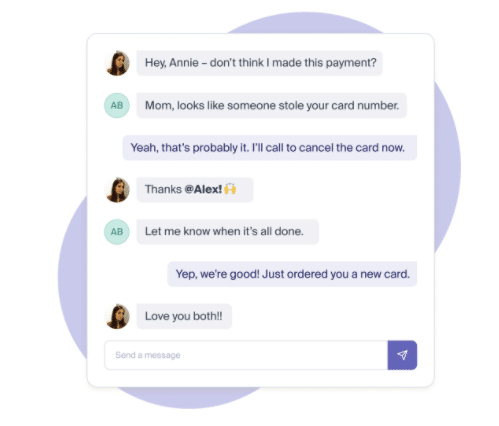

Carefull’s secure circle of support

Plus, Carefull makes it easy to keep the lines of communication open with others involved in your parent’s care.

You can add trusted family members and financial professionals to your secure “Circle” of support so they, too, can get alerts when something might be wrong.

Then, all of you can communicate securely within the Carefull service to coordinate and resolve issues.

Click here to start your free trial and claim 40% off for life with coupon code DAILYCARING »

Two alternatives to joint accounts

If you need the ability to do more than just monitor your parent’s account, there are two additional steps you can take that can be better alternatives to a joint account.

1. Signature authority on accounts

Rather than make you a joint account owner, your parent could make you an authorized signer on the account. This would allow you to make transactions on your parent’s behalf.

However, you might be limited to certain transactions — depending on what type of signature authority your parent wants to give to you.

2. Power of attorney

Your parent could name you as their power of attorney (POA) to allow you to make financial transactions for them.

This can be done by meeting with an estate planning or elder law attorney, who will draft a power of attorney document.

As your parent’s power of attorney, you could gain access to all of your parent’s financial accounts, not just the bank account.

However, you are required to act as a fiduciary, which means you must manage your parent’s money for their benefit rather than yours.

Ideally, you or your parent should notify his or her financial institutions if you’ve been named power of attorney. Then, your parent can sign any additional documents the financial institutions may require.

If your parent hasn’t notified their bank or other financial institutions of your POA status and you need to start acting on your parent’s behalf, you’ll need to provide the financial institutions with a copy of the POA document (pro tip: don’t give them the actual document).

Keep in mind that as their power of attorney, you won’t become the owner of their accounts. You’ll simply be managing those accounts and making transactions on your parent’s behalf.

Also, you shouldn’t use your power of attorney to take over your parent’s finances if they are still competent to handle things on their own.

Before making any decisions, consider discussing the options with a financial planner or accountant. A financial professional can help you and your parent chart the best course.

Next Step Download our free 30 page Financial Caregiving Roadmap

By Cameron Huddleston, family finance expert and head of content at Carefull

About Carefull: Carefull is a smart “second set of eyes” for the daily money, credit, and identity monitoring of someone you care about.

This article is sponsored by Carefull. For more information, see How We Make Money.

[optin-monster slug=”yxbytm35zhsdfopnw7qk”][optin-monster slug=”jvhyplxmb4umsjazxecn”]

About the Author

Connie Chow

Connie was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also knows how important support is — especially in the form of practical solutions, valuable resources, and self-care tips.