Avoiding end-of-life conversations is a natural tendency. But not having the proper legal documents in place could create big problems and possibly become very expensive if your older adult becomes incapacitated or suddenly passes away. Bestow shares 5 essential end-of-life documents that seniors need to complete.

When it comes time to face end-of-life issues, the majority of Americans are unprepared.

According to a recent study, 80 million American families reported that they haven’t had a conversation about end of life and 70% of end-of-life discussions occur only after a traumatic event or health crisis.

But it’s important to cover these types of issues before a crisis. Otherwise, families can get blindsided by the legalities and regulations surrounding end-of-life care.

So, how exactly do you prepare for end of life? One of the first things you can do is address important end-of-life documents.

Take advantage of the time you have now and make a point to discuss end-of-life planning with your older adult and help them put the necessary paperwork in place.

We share 5 essential end-of-life documents you need to know about and explain why they’re necessary.

1. Last will and testament

A last will and testament, also known as a will, is a document that states your older adult’s last wishes regarding their estate after they die.

Generally, a will should include the following items:

- Executor – A personal representative, be it a person or institution, that sees to it that wishes are carried out as specified in the will.

- Beneficiaries – The person or people who will receive their property.

- Personal properties – Assets they may want to divide between beneficiaries.

- Business assets – Business assets are typically distributed separately from personal property, so specifying to whom and how business interests are to be divided is essential.

- Debts, expenses, and taxes – Final expenses should be addressed as well. For instance, how will the funeral be financed, or how is inheritance and estate tax to be handled?

- Special instructions – If there are special instructions, like how their home is to be cared for, or arranging a caretaker for their pet, it should be included.

If they have a complicated financial situation, like property in other states or a substantial estate, then they will want to be as specific as possible when writing their will. Otherwise, probate court will determine how and to whom their property is divvied out and will collect court costs directly from the estate.

2. Power of Attorney

A power of attorney (POA) authorizes another person the right to act on your older adult’s behalf in legal, personal, medical, or business matters.

There are different degrees of power that can be granted, which must be determined by your older adult.

Here are four types of power of attorney to be aware of:

General Power of Attorney

A general POA gives the agent (the appointed person) the power to sign documents, pay bills, and make financial transactions on your older adult’s behalf. This POA terminates when they die.

Limited Power of Attorney

A limited POA has a very specific purpose, such as giving the agent the power to represent and act for your older adult on a specific day and time.

After the agent has fulfilled their purpose, the POA terminates.

Healthcare Power of Attorney

A healthcare POA comes into effect once your older adult is considered legally incapacitated by their doctor or they are no longer able to make medical decisions on their own.

A healthcare POA specifically allows the agent to make medical decisions on your older adult’s behalf.

Durable Power of Attorney

Durable POAs come into effect when your older adult is incapacitated.

The extent of power the agent has must be specified in the document beforehand, but usually allows them to make financial and/or medical decisions.

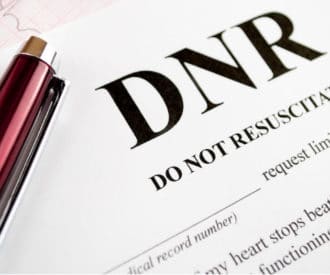

3. Advanced healthcare directives / living wills

Advanced healthcare directives (also called living wills) are instructions provided by your older adult. They specify how they would like to be cared for when they are no longer able to make decisions themselves.

These documents typically state wishes regarding treatments like life support or pain medication. Family, hired caregivers, and doctors use it as a guide for care decisions.

4. HIPAA waiver of authorization

A Health Insurance Portability and Accountability Act (HIPAA) waiver of authorization is a legal document stating that protected health information (PHI) can be shared between third parties outside of your older adult’s healthcare provider.

That can include doctors, caregivers, attorneys, researchers, or family members.

Without this document, your older adult’s appointed health care proxy (the agent that holds the healthcare POA) may not be allowed to freely discuss matters regarding PHI or other medical conditions with a physician or caregiver.

5. Authorized user on investment and bank accounts

Lastly, it’s wise for your older adult to authorize a trusted person to have access to their accounts.

Otherwise, if they become incapacitated or pass away suddenly, it will become very complicated to gain access to those accounts.

This is especially important if family or loved ones are dependent on them for financial support. By granting someone access to these accounts, your older adult can ensure that those people will be taken care of.

Recommended for you:

- 7 Sources of Free Legal Services for Seniors

- Caregiving Legal Basics: Essential Documents and Tasks

- How to Help Aging Parents with Finances: Getting Started Guide

Guest contributor: Zachary Painter writes on behalf of Bestow with an interest in topics like health, wellness, and tech. Specifically, he is interested in covering how these topics intersect, and how tech can be utilized to help us live happier, healthier lives. His most recent guide covers end-of-life planning, and discusses how adult children and their parents can work through end-of-life issues together.

Image: Caring Nurses

This article wasn’t sponsored and doesn’t contain affiliate links. For more information, see How We Make Money.

[optin-monster slug=”yxbytm35zhsdfopnw7qk”][optin-monster slug=”jvhyplxmb4umsjazxecn”]

How do you get a medical power of attorney

Since this is a legal document, it’s best to speak with an attorney to draw up the correct papers (ideally an elder law attorney who specializes in this area).