Estate planning is a vital yet often delayed process that provides profound care and foresight for seniors and their families. It goes beyond asset distribution to encompass critical decisions about healthcare, financial management, and personal legacy, ensuring that an individual's wishes are honored with clarity and dignity.

This guide breaks down the essential components of estate planning into clear, manageable steps, from wills and trusts to powers of attorney and advance directives. By demystifying the basics, it empowers older adults and their caregivers to take proactive control, transforming a complex subject into an accessible roadmap for securing peace of mind and protecting loved ones from future uncertainty and conflict.

Creating an estate plan isn’t just about what happens after a loved one passes away; it’s about providing peace of mind and clear instructions for their care and finances while they are still with us.

What Constitutes an Estate in 2026?

An “estate” is everything a senior owns and owes. In 2026, this definition has expanded to include three distinct categories:

Tangible Assets: The family home, cars, jewelry, and bank accounts.

Digital Assets: This is now a critical part of estate planning. It includes social media accounts, cryptocurrency and NFTs, digital photos, and online subscription services.

Liabilities: Mortgages, credit card debt, and final medical bills that must be settled before heirs receive their inheritance.

Key Documents Every Aging Adult Needs

A modern estate plan is more than just a Will. To ensure complete protection, these five documents are essential:

1. Last Will and Testament: Outlines who receives physical and financial assets.

2. Living Trust: Often used to avoid the time and cost of probate. In 2026, trusts are increasingly used to manage “Digital Property” and protect assets from high long-term care costs.

3. Financial Power of Attorney: Designates a trusted person to manage money if the senior becomes incapacitated.

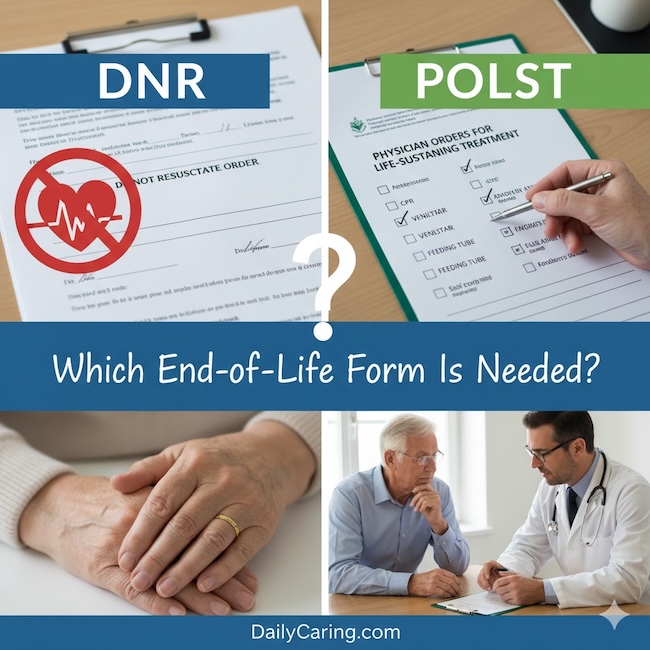

4. Advance Healthcare Directive (Living Will): Clearly states medical wishes, such as preferences for life support or Do Not Resuscitate (DNR) orders.

5. Digital Power of Attorney: A newer necessity that gives a “Digital Executor” the legal right to access online accounts and encrypted data.

Important Updates for 2026

Recent legislation has changed the rules. Here is what you need to know:

| Feature | 2026 Update |

|---|---|

| Federal Estate Tax Exemption | Now permanently set at $15 million per person ($30 million for couples) under the One Big Beautiful Bill Act. |

| Inherited IRAs | Most non-spouse beneficiaries must now withdraw all funds within 10 years, which can create a large tax bill for heirs. |

| RMD Ages | The age for Required Minimum Distributions (RMDs) has shifted to 75 for those born in 1960 or later, allowing retirement funds to grow longer. |

| Digital Property Law | New laws clarify that digital assets are personal property, making it easier for executors to recover “lost” online accounts. |

Simple Steps to Get Started with an Estate Plan

1. Inventory Everything: Don’t forget the “invisible” assets, such as cloud storage and loyalty points.

2. Check Beneficiaries: Many seniors don't realize that beneficiary designations on IRAs and life insurance policies override what's written in a Will.

3. Appoint a Digital Executor: Choose someone tech-savvy to manage the closure of social media accounts and the retrieval of digital memories.

4. Consult an Expert: Because laws regarding irrevocable trusts and asset protection are complex, meeting with an elder law attorney is highly recommended.

VIDEO: Estate Planning 101: How to Appoint an Executor

Final Thoughts on Estate Planning in 2026

Initiating or updating an estate plan is one of the most responsible and loving actions an older adult can take, providing immeasurable peace of mind for themselves and their family. By addressing these fundamental elements (a will, trusts, powers of attorney, and advance directives), you create a comprehensive framework that protects your assets, outlines your healthcare preferences, and minimizes the burden on your loved ones during difficult times.

While the process may seem daunting, taking it step by step with professional guidance makes it entirely achievable. Ultimately, a complete estate plan is not just about documents; it's a lasting gift of clarity, security, and love, ensuring your legacy is preserved exactly as you intend.

Next Steps: Understand the basics with the Estate Planning Guide at RocketLawyer

Recommended for you:

- 7 Sources of Free Legal Services for Seniors

- Caregiving Legal Basics: Essential Documents and Tasks

- 5 Smart Tips for Hiring an Elder Law Attorney

About the Author

Connie is the founder of DailyCaring.com and was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also understands the importance of support, especially in the form of practical solutions, valuable resources, and self-care tips.