Managing medical bills is a necessary part of caregiving

Managing medical bills is part of the job when you’re caring for an older adult. Unfortunately, those bills are often complicated, filled with errors, and sometimes beyond your older adult’s budget.

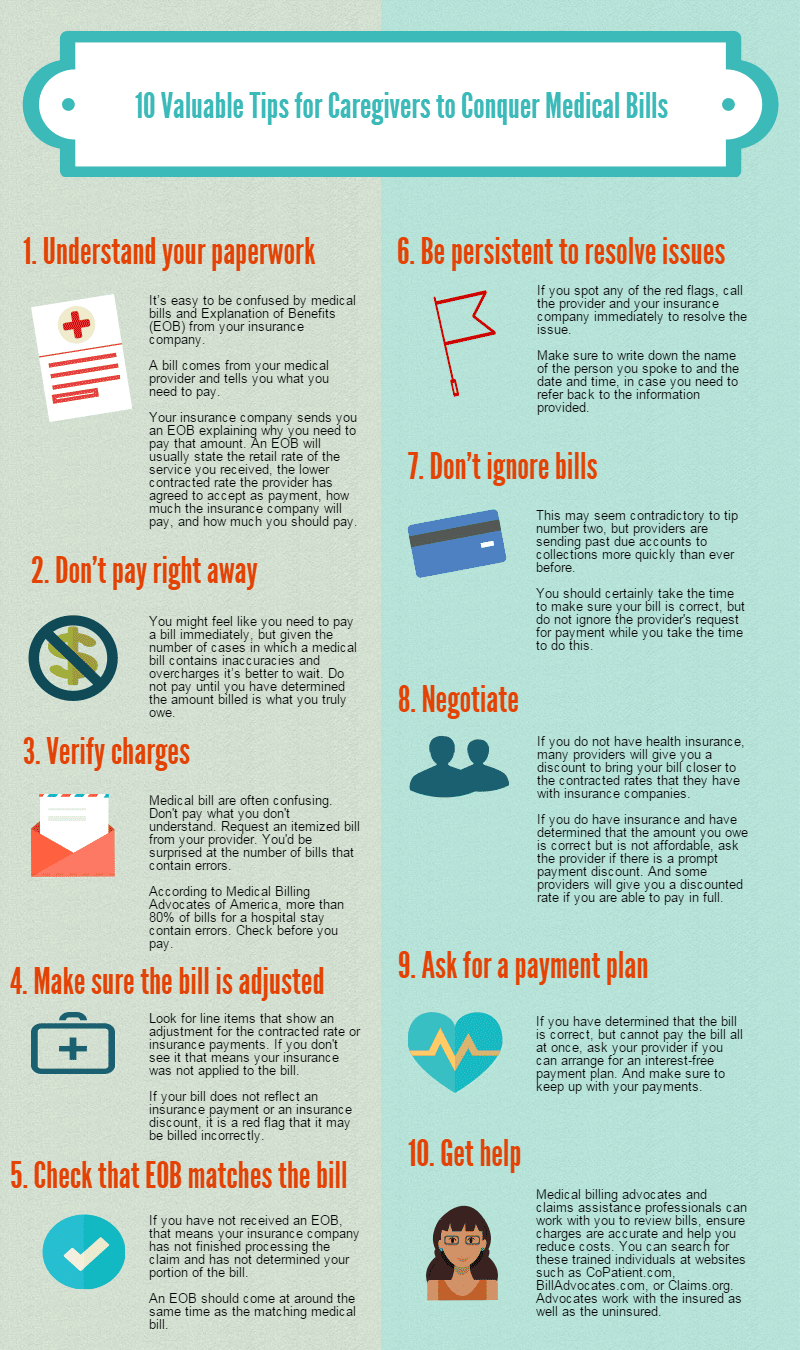

We found a helpful image that breaks down medical bill management into 10 clear steps. This organized list makes the job much easier to tackle and helps you negotiate discounts or payment plans.

10 steps for managing medical bills

Many seniors have multiple health conditions, see several specialists, get hospitalized, or regularly have complex treatments. That means they get a lot of confusing medical bills.

This image will help you focus on one step at a time. After going through this list, you’ll be confident knowing that the bill is correct and that the payment plan is the best one possible for your older adult’s financial situation.

Recommended for you:

— How to Lower Medical Bills: CoPatient Helps Seniors and Caregivers

— What You Need to Know About Medicare Coverage for Hospital Stays

— 5 Steps to Take When Medications Are Not Covered by Medicare

By DailyCaring Editorial Team

Infographic: PainPathways

Image: Credit and Debt Management

[optin-monster slug=”yxbytm35zhsdfopnw7qk”][optin-monster slug=”jvhyplxmb4umsjazxecn”]

About the Author

Connie Chow

Connie was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also knows how important support is — especially in the form of practical solutions, valuable resources, and self-care tips.