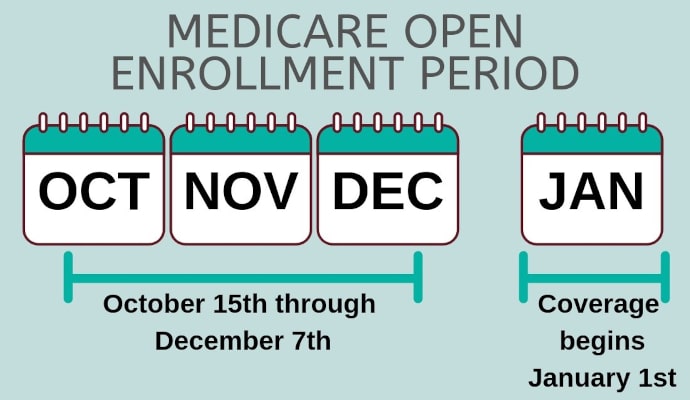

Medicare Open Enrollment is Oct 15 to Dec 7

Medicare open enrollment or annual election period (AEP) is an enrollment period that happens every year in the fall.

During this time, Medicare plan enrollees can reevaluate their existing Medicare coverage and make changes if they choose to do so.

For 2025 healthcare coverage, Medicare’s annual Open Enrollment period runs from October 15 to December 7, 2024. Coverage will begin on January 1, 2025.

During Medicare Open Enrollment, seniors can:

- Switch from Original Medicare to a Medicare Advantage plan

- Change from Medicare Advantage to Original Medicare

- Select a different Medicare Advantage plan

- Choose a different Medicare prescription drug plan

Changes made during Open Enrollment will take effect on January 1, 2025. And after December 7th, no further changes to Medicare coverage can be made for 2025 (unless a special enrollment period applies to your situation).

We explain why reviewing and making changes to your older adult’s medical and prescription plans can help them save money and improve next year’s coverage.

We also share how to know which plan changes to focus on, how to compare 4 key areas of coverage, and 4 ways to get help with Medicare decisions.

Why do seniors need to make changes to their Medicare plans?

Medicare health and drug plans can change each year: costs, coverage, and which providers and pharmacies are in-network.

That means the plan that covered everything your older adult needed this year might not have the same coverage next year.

This is especially true for Part D prescription drug plans.

When the plans change, this could result in significant increases in next year’s healthcare costs.

But often, changing to a different plan could get the coverage your older adult needs without increasing their premium or out-of-pocket costs.

And, there’s always the chance that a plan with a lower premium could provide the coverage they need.

The Annual Notice of Change letter highlights important changes

To find out what’s changing in your older adult’s current Medicare plans, look for the Annual Notice of Change (ANOC) letter.

The ANOC is a helpful summary that highlights any changes in coverage, costs, or service area that will be effective in January 2025.

Medicare plans send their ANOC letters in early October and Medicare Advantage plans typically send theirs in September.

Compare 4 important areas of Medicare coverage

1. Premiums

Is the plan premium going up? If the increase is significant, there might be a different plan that gives similar coverage at a lower price.

2. Deductibles and co-pays

What are the current deductibles and co-pays? Will these be increasing next year?

3. Prescription drug coverage

Medication that’s not covered is expensive. Paying special attention to prescription drug plans could save a lot of money.

It’s time-consuming, but necessary to find out how changes in drug plan premiums, formulary, and pricing tiers will affect the cost of medications your older adult takes.

Typically, a plan could raise premiums, add or remove drugs from their formulary, change pricing, or move drugs from one price tier to another.

Look up each of your older adult’s medications so you’ll know:

- If it’s covered in the plan’s formulary

- Which pricing tier the medication is in

- How much the drugs in that tier will cost

It’s also important to know if your older adult’s preferred pharmacy is in the plan’s network (prices are lowest in-network) and if there are any restrictions, like prior authorization or being forced to try a certain drug first.

Estimating those costs and taking restrictions into account gives you a clear picture of which 2025 plan will provide the most cost-effective prescription drug coverage.

Note: A plan’s formulary is the list of covered medications. Most prescription drug plans have 5 pricing tiers — preferred generics, other generics, preferred branded drugs, other branded drugs, and expensive specialty medications. Each tier has a different cost.

4. Part C / Medicare Advantage / Managed Care

If your older adult has a Medicare Advantage plan, call their current doctors, hospitals, specialists, and other providers to make sure they’ll still be in the plan’s provider network in 2024.

4 ways to get help with Medicare Open Enrollment

Comparing Medicare plan options can be overwhelming. Get additional help and information from these 4 reputable sources.

1. Contact your local SHIP office

Getting expert advice can save hours of your time. The State Health Insurance Assistance Programs (SHIPs) give free, in depth, one-on-one insurance counseling and help.

A counselor who understands Medicare and Medicaid can guide you to smart options for your older adult’s personal situation.

You can trust them because SHIPs are government programs funded by the federal U.S. Department of Health and Human Services.

Find your state’s SHIP office >

2. Contact your local Area Agency on Aging

Call the local Area Agency on Aging and ask if they have programs that help with Medicare Open Enrollment.

Find your local Area Agency on Aging >

3. Use Medicare’s online plan finder

Medicare has an online plan finder and comparison tool. Answer a few quick questions and the tool will show available plan options for 2024.

Use Medicare’s online plan finder >

Note: There is a separate Medigap Policy plan finder

4. Call 1-800-MEDICARE (1-800-633-4227)

You can also call the Medicare office and ask a representative to run a search for plan options and mail you the results. This takes extra time, so call ASAP if you want to use this method.

Recommended for you:

- Medicare vs. Medicaid: What You Need to Know

- What Does Medicare Cover? Find Out Before the Bills Arrive

- 3 Mistakes That Cost Medicare Beneficiaries a Fortune

By DailyCaring Editorial Team

Image: MedicareAdvantage.com

This article wasn’t sponsored and doesn’t contain affiliate links. For more information, see How We Make Money.

About the Author

Connie Chow

Connie was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also knows how important support is — especially in the form of practical solutions, valuable resources, and self-care tips.