Imagine finding the perfect senior care solution, only to have your hopes dashed by a staggering price tag. For millions of families, the soaring cost of care for an aging loved one isn’t just a line item in a budget; it’s a source of profound stress, guilt, and sleepless nights.

The question “How will we afford this?” echoes in living rooms across the country, turning a journey of compassion into a financial crisis. But what if affordable care wasn't a distant dream? The truth is, with the right strategies and resources, you can navigate this complex landscape without sacrificing quality or peace of mind.

All Home Care Matters explores practical, often overlooked ways to ease the financial burden and secure the compassionate care your family deserves.

Senior Care is a Costly Endeavor

As older generations age, their healthcare needs become more complex and costly.

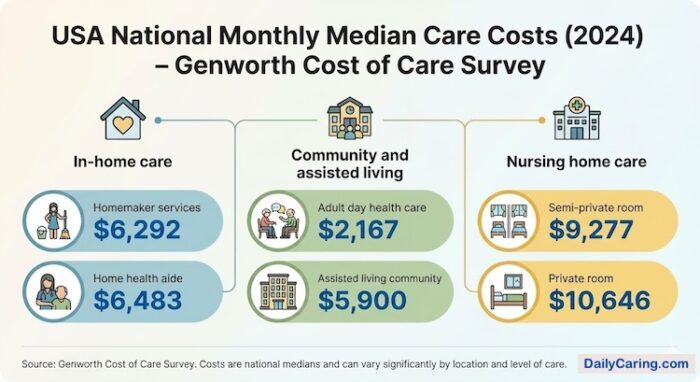

According to Genworth’s most recent analysis of care costs, the national average cost of in-home care is approximately $6,483 per month (or $33- $35 per hour).

Additionally, seniors who need memory care can expect an additional 20-30% increase in monthly costs.

As a result, many families struggle to afford the care their loved ones now require.

Regardless of whether it’s in-home care, assisted living, or memory care that your loved one needs, the costs can quickly add up. Many families are left wondering how they will possibly afford it.

Fortunately, several resources are available to help families and caregivers pay for essential care. Here, we discuss seven ways to pay for senior care.

7 Ways to Help Pay for Senior Care

1. Participate in Medicare and Medicaid Programs – If Eligible

Medicare and Medicaid are the two most common government-funded programs that help families pay for senior care costs.

Medicare is a federal program that provides health insurance to individuals age 65 or older and those with specific disabilities.

However, Medicare does not cover long-term care, so it’s most helpful for immediate healthcare needs.

On the other hand, Medicaid provides healthcare coverage to low-income individuals, including older adults.

Medicaid does cover long-term care, which helps many families. Eligibility for Medicaid varies by state, but generally, individuals must have limited income to qualify.

2. Take Advantage of Your Veterans' Benefits

Some veterans and their spouses may be eligible for VA benefits to help cover care costs.

The VA offers a variety of programs, including Aid and Attendance, which provides financial assistance to veterans and their spouses who require help with daily living activities.

3. Use Your Long-Term Care Insurance Policy (If You Purchased One)

This form of insurance is designed to help cover the costs of long-term care options, including memory care.

Long-term care insurance policies vary, but generally cover services such as nursing home care, in-home care, and assisted living.

Premiums for long-term care insurance can be costly, but they may be worth it if the policyholder requires long-term care throughout their lifetime.

4. Consider Home Equity Loans and Credit Only if Necessary

Families may also use a home equity loan or line of credit to pay for their loved ones' care costs.

With a home equity loan, the borrower receives a lump sum and repays it, with interest, over time.

While this may not be very encouraging to some, the advantage of this option is that it is relatively easy to obtain.

Additionally, the borrower can draw on the line of credit as needed and pays only interest on the amount they’ve borrowed.

Home equity loans and lines of credit can be an excellent option for older adults with significant home equity.

5. “Crowdfunding” is an Interesting Option When it Comes to Paying for Senior Care

Crowdfunding is a relatively new way to raise funds to cover healthcare costs.

Websites like GoFundMe allow families to create fundraising-style campaigns and share them online to raise money for care costs through donations.

While crowdfunding can be a quick way to raise money, it’s helpful to be aware of the hidden fees some crowdfunding websites charge and to consider the potential impact on privacy carefully.

6. Non-Profit Organizations May Offer Assistance

Countless non-profit organizations assist seniors and their families, each offering unique benefits.

These organizations typically offer financial assistance and, in some cases, provide additional services, such as counseling and caregiver support groups.

Just a few of the non-profit organizations that can assist seniors include the Alzheimer’s Association, National Council on Aging, and New York’s Elderly Pharmaceutical Insurance Coverage program.

7. Other Options For Making Senior Care More Affordable

If none of the above options suit your family’s needs or feel like the right fit, there are some additional options to consider.

Understandably, not all older adults require the same level of care, and many families are fortunate to have family members who can step in and provide regular support.

Caregiving can be an exhausting responsibility, and respite care is a more affordable option that offers caregivers a much-needed break.

Additionally, according to the Genworth Cost of Care Survey, adult day programs are another less costly option that can be used on an as-needed basis. They vary in price, but the national average in 2024 was $100 per day. Other sources peg that number at around $103 per day in 2025.

Final Thoughts on Making Senior Care More Affordable

Navigating the cost of senior care is undeniably challenging, but it's important to remember you are not without options or support. By combining these creative strategies – from leveraging hidden benefits to rethinking the care model itself – you can build a sustainable plan that protects both your loved one’s well-being and your family’s financial future.

The path to affordable care begins with knowledge and a willingness to explore every avenue. Start with one step, reach out for help, and reclaim the sense of possibility. After all, providing for a loved one in their later years should be an act of love, not a source of endless financial fear.

Recommended for you:

- Affordable Home Care: 8 Ways to Lower Senior Care Costs

- 3 Tips to Choose Between Assisted Living vs In-Home Care

- When They Say No: 8 Ways to Introduce In-Home Care for Seniors

Guest contributor: Whether you’re a caregiver looking to enhance your knowledge and skills or simply seeking to learn more about dementia home care, All Home Care Matters offers a must-listen podcast and YouTube channel.

References:

– Genworth Cost of Care Survey

– Adult Day Care Costs 2023

About the Author

Lance A. Slatton CSCM – Known as “The Senior Care Influencer” is a Writer, Author, Influencer, and Healthcare professional with over 20 years in the healthcare industry. He is a senior case manager at Enriched Life Home Care Services in Livonia, MI. Lance A. Slatton is also the host of the award-winning podcast & YouTube channel All Home Care Matters.