For many families, 2026 is the year of the “Right-Sized Move.” Consider the story of “The Millers,” a couple who spent 30 years in a high-tax New Jersey suburb. As they approached retirement, they realized that staying in their family home would mean paying nearly 12% of their fixed income to the state. By moving just a few states away to Delaware, they could save thousands annually—money that could be spent on travel or their grandchildren instead of state coffers.

When you're moving for retirement, your new zip code dictates more than just the weather; it determines how much of your nest egg you actually keep. Before you pack the first box, you must understand the difference between a state's general tax burden and its specific tax friendliness toward seniors.

Understanding the 2026 Retirement Tax Landscape

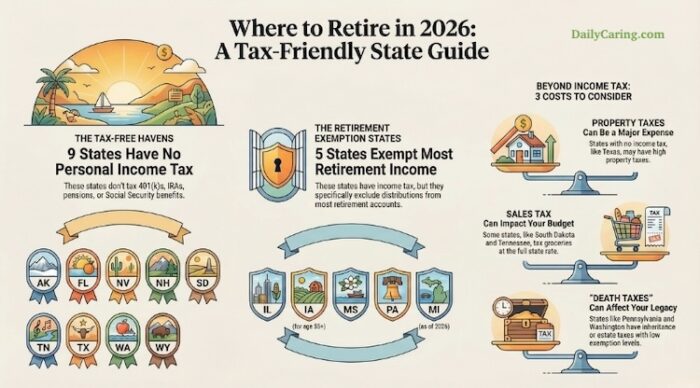

A state's total tax burden measures the percentage of personal income paid toward state and local taxes. However, a state with a high overall burden might still be a tax-friendly state for retirees.

For example, Illinois maintains a higher-than-average tax burden for workers. Still, it remains a haven for seniors because it exempts all retirement income—including pensions, 401(k)s, and IRAs—from state taxation.

Major 2026 Tax Updates for Seniors

Several states have recently overhauled their codes to attract retirees:

- Social Security Tax Exemptions: As of 2026, West Virginia has wholly joined the ranks of states that do not tax Social Security benefits, providing a significant boost to those on fixed incomes.

- Retirement Income Protection: Iowa now offers a 100% exemption on retirement income for residents aged 55 and older, while Mississippi has lowered its flat tax rate to 4.0% for 2026.

- Investment Income: New Hampshire has repealed its tax on interest and dividends, making it a true “no-income-tax” destination.

Top 10 States with the Lowest Retirement Tax Burden

These states are the “all-stars” for 2026, offering the best balance of low income, property, and sales taxes for older adults.

| Rank | State | 2026 Retirement Tax Profile |

|---|---|---|

| 1 | Alaska | Lowest overall tax burden in the U.S. (~4.9%). No state income or sales tax. |

| 2 | Wyoming | No personal income tax and exceptionally low property taxes (~0.6%). |

| 3 | Florida | No state income, estate, or inheritance tax. Robust senior homestead exemptions. |

| 4 | Tennessee | No income tax and low property taxes, though sales tax on goods is high. |

| 5 | Delaware | No sales tax and low property taxes; offers generous pension exclusions for ages 60+. |

| 6 | South Dakota | No income tax. Warning: Groceries are taxed at the full state rate. |

| 7 | Nevada | No income tax. Effective property tax rates are among the nation's lowest. |

| 8 | Texas | No income tax. High property taxes are often offset by no tax on retirement accounts. |

| 9 | Mississippi | Exempts almost all retirement income (401k/IRA/Pension) for seniors. |

| 10 | Pennsylvania | Exempts retirement income from state tax, though local taxes vary by county. |

Watch Out for the “Least Friendly States for Retirement”

At the other end of the spectrum, these states feature high retirement tax burdens that can quickly erode a fixed income:

- New York: Leads the nation with a total tax burden of over 15%.

- New Jersey: High property taxes and a top income tax rate of 10.75%.

- Vermont: One of the few states that continues to tax Social Security for many middle-income earners.

- Connecticut: Aggressively taxes retirement distributions for those exceeding income thresholds ($75k single/$100k joint).

Summary Checklist: The “Hidden” Retirement Costs

Beyond income tax, savvy seniors must look at:

- Grocery Taxes: States like Alabama and South Dakota still tax essential food items.

- Inheritance and Estate Taxes: Ensure your legacy is protected; states like Oregon and Washington have much lower exemption thresholds than the federal government.

- Car Fees: Watch for states with high “hidden” taxes like Wyoming’s $200 annual fee for electric vehicles.

2026 Property Tax Relief Measures By State

Many states have introduced significant property tax relief measures specifically for the 2026 tax year to help seniors manage rising home values on fixed incomes. Recent changes in states like New Jersey and Montana are particularly noteworthy for their substantial new benefits.

Below is a summary of key state programs offering property tax relief to seniors in 2026.

| State | Primary Program | Relief Type | 2026 Key Benefit / Limit |

|---|---|---|---|

| New Jersey | Stay NJ | Rebate | Up to $6,500 rebate; first payouts start early 2026. |

| Montana | PTAP | Exemption | Tiered reduction (30-80%) based on income. |

| Florida | Senior Exemption | Exemption | Extra $50,000 homestead exemption for low-income seniors. |

| Illinois | SCAFHE | Freeze | Assessment freeze; income limit increased to $75,000. |

| Texas | School Tax Freeze | Freeze | School portion of tax bill remains frozen at age 65 amount. |

| Colorado | Senior Exemption | Exemption | 50% of the first $200,000 in home value is exempt. |

| Idaho | Reduction Program | Credit | $250 to $1,500 reduction for income under $39,130. |

| Alabama | State Exemption | Total Exemption | Seniors 65+ pay zero state-level property tax. |

Applying for Property Tax Relief Programs in 2026

Applying for property tax relief can be a complex process. Still, most states follow a similar pattern: you must meet residency and age requirements, verify your income, and submit your application by a specific spring or summer deadline.

How to Apply: A Quick Guide for Seniors

- New Jersey (Stay NJ): Applications are typically combined with other programs like ANCHOR. You will need your 2024 tax return and property tax bill. The 2026 application process is expected to begin in early 2026.

- Montana (PTAP): You must apply by April 15, 2026. The application requires your federal adjusted gross income (FAGI) and proof of residency for at least seven months of the year.

- Florida (Senior Exemption): The primary deadline is March 2, 2026. You must already have a standard Homestead Exemption and then submit a “Sworn Statement of Adjusted Gross Income” to your local county property appraiser.

- Illinois (Senior Freeze): Applications are usually available through your county assessor in April. You must verify that your total household income is below the $75,000 threshold.

- Texas (Tax Freeze): You can apply as soon as you turn 65; you don't have to wait until the start of the year. Use the “Application for Residential Homestead Exemption” and submit it to your local appraisal district.

2026 Property Tax Application Deadlines & Links

| State | 2026 Deadline | How to Apply |

|---|---|---|

| New Jersey | Early 2026 | Apply online via the Stay NJ Portal. |

| Montana | April 15, 2026 | Submit Form PTAP to your Local Revenue Office. |

| Florida | March 2, 2026 | Contact your County Property Appraiser. |

| Illinois | Varies by County | Download forms from your Assessor’s Website. |

| Texas | April 30, 2026 | File with your Appraisal District. |

| Colorado | July 15, 2026 | Mail the Senior Exemption Form to your Assessor. |

| Idaho | April 15, 2026 | Apply at the State Tax Commission. |

3 Additional Tax Considerations for an Affordable Retirement Destination

1. Healthcare Affordability in 2026 and Beyond

While tax rates matter, healthcare costs are often a retiree's most significant expense. For 2026, ACA Marketplace premiums are projected to rise by a median of 18%, primarily driven by the high cost of new specialty medications.

When moving, seniors should look at the Healthcare Cost Index. States like Mississippi, Tennessee, and Texas consistently rank lower for healthcare prices, which can often save a retiree more than a slight difference in income tax.

2. The New 2026 “Federal Senior Deduction”

Many retirees aren't aware that for the 2026 tax year, a new federal senior deduction of $6,000 is available for those 65 or older.

- Eligibility: Single filers with a MAGI (Modified Adjusted Gross Income) under $75,000 (or $150,000 for married joint filers).

- Bonus: This is in addition to the existing standard deduction for seniors, potentially shielding a significantly larger portion of their income from federal taxes.

3. Legacy Protection: Estate and Inheritance Taxes

Moving to a state with no income tax won't help if that state takes a large chunk of your estate later. While most states have abolished “death taxes,” a few “tax-friendly” states like Pennsylvania still have an inheritance tax. Conversely, states like Oregon and Massachusetts have estate tax thresholds as low as $1 million, meaning even a modest home can trigger a state tax bill for heirs.

VIDEO: Best States to Retire in 2026 – Taxes and More!

Protecting Your Legacy: Don’t Let “Death Taxes” Shrink Your Estate

Choosing a retirement destination based on a 0% income tax rate is a great start, but savvy planning doesn't stop at your annual tax return. For many, the goal of a “right-sized move” is to ensure that as much of their hard-earned nest egg as possible eventually passes to their children or grandchildren.

Unfortunately, some otherwise “tax-friendly” states can surprise your heirs with significant estate or inheritance taxes. While the federal estate tax exemption is relatively high (currently over $15 million for 2026), several states trigger their own “death taxes” at much lower levels. In states like Oregon or Massachusetts, a modest home and a standard retirement account could be enough to leave your family with a surprise tax bill.

Before you finalize your move, check how your target state handles your legacy:

2026 Estate and Inheritance Tax Summary (by State)

| State | Estate Tax Threshold | Inheritance Tax? | Legacy Notes |

|---|---|---|---|

| Oregon | $1,000,000 | No | Lowest threshold in the U.S.; easy to trigger with a home. |

| Pennsylvania | None | Yes | No estate tax, but heirs pay 4.5% to 15% inheritance tax. |

| Massachusetts | $2,000,000 | No | Exemption recently doubled, but still impacts many homeowners. |

| New Jersey | None | Yes | Spouses/children are exempt, but siblings/others are taxed. |

| Washington | ~$2.19 Million | No | Exemption is indexed for inflation; highest top rate at 20%. |

| Florida / TX / NV | None | No | Purely follow federal limits (currently ~$15M for 2026). |

Next Steps: Preparing to Retire in a New State

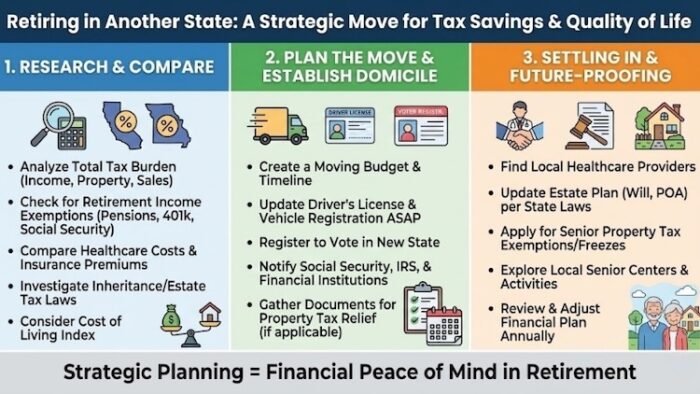

This Checklist is designed to help you navigate the transition from your current home to a tax-friendly destination. Moving for tax purposes requires more than just a new address; it involves “breaking” your connection to your old state and establishing a clear domicile in the new one to avoid being double-taxed.

Phase 1: The Comparison Deep Dive

- Run a “Total Cost” Simulation: Use online calculators to compare your current city with the new one. Factor in housing, utilities, groceries, and especially healthcare premiums, which are projected to rise significantly in 2026.

- Investigate “Hidden” State Taxes: Beyond income tax, check if the state taxes Social Security (9 states still do in some form), private pensions, or 401(k) withdrawals.

- Consult a Multi-State Tax Pro: If you have significant assets, a CPA can help you understand the specific “statutory residency” rules to ensure both states don't tax you during your transition year.

Phase 2: Establishing Domicile (Proving Your Move)

- Update Your Identity: Obtain a new driver's license and register your vehicles in the new state as soon as you arrive.

- Register to Vote: This is one of the strongest legal indicators of your intent to make a state your permanent home.

- Notify the “Big Three”: Update your address with the Social Security Administration, the IRS (Form 8822), and your pension or benefit administrators.

Phase 3: Legal & Property Preparation

- Gather Property Relief Docs: Start a folder for your property tax application. You will likely need your 2024 Federal Adjusted Gross Income (FAGI) statement, your property deed, and proof of residency, like a utility bill.

- Localize Your Estate Plan: State laws on probate and trusts vary wildly. Have a local attorney review your will, Power of Attorney, and healthcare directives to ensure they are enforceable in your new state.

- Establish Local Healthcare: Find new primary care providers and specialists who accept your insurance. Transfer medical records and prescriptions early to avoid gaps in care.

Summary of Next Steps: Your Action Plan

| Move Phase | Priority Action Item | Why It Matters |

|---|---|---|

| 1. Research | Analyze Total Tax Burden | Low income tax might be offset by high property or sales taxes. |

| 2. Domicile | License & Voter Registration | Legally proves your intent to reside in the new state. |

| 3. Property | Apply for Senior Relief | Provides significant annual savings on your home tax bill. |

| 4. Estate | Localize Legal Documents | Ensures your will and POA follow local state probate laws. |

| 5. Healthcare | Verify Network Coverage | Avoids expensive out-of-network costs for specialists. |

The Bottom Line: A Strategic Move for a Brighter Future

Relocating in retirement is about more than just finding a lower tax rate; it's about maximizing your quality of life by keeping more of your hard-earned savings. By choosing a state that offers a lower total tax burden, you aren't just saving on your annual tax bill – you are freeing up funds for high-quality healthcare, travel, and the legacy you wish to leave behind.

While establishing a new domicile requires careful planning and a bit of paperwork, the long-term financial peace of mind is often well worth the effort. Whether it’s enjoying a tax-free Social Security check in West Virginia or a significant property tax rebate in New Jersey, the right “retirement move for 2026” can ensure your nest egg lasts as long as you do.

Recommended for you:

- Cost of Long Term Care: 5 Ways Estimates Help Seniors and Caregivers

- Financial Help for Seniors: 2,500+ Federal, State, & Private Benefits Programs

- How to Help Aging Parents with Finances: Getting Started Guide

About the Author

Chris is a seasoned healthcare executive and entrepreneur from the Pacific Northwest. He strongly advocates for older adults and the caregivers who serve them. Chris has personal experience caring for his father, who had dementia. Chris is an avid outdoorsman; if he's not in his office, he can usually be found on a golf course or in a garden out west somewhere.