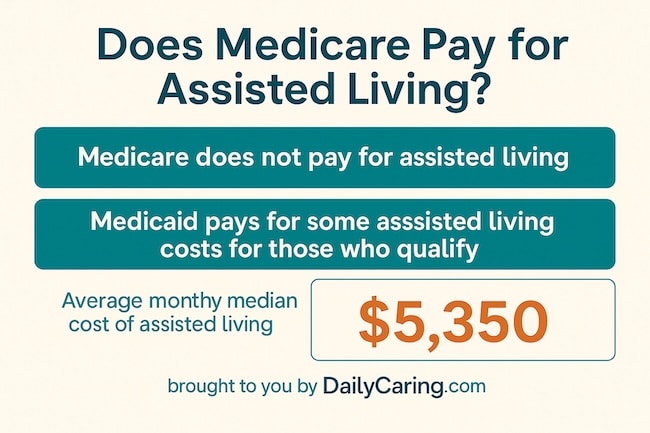

The cost of assisted living can feel overwhelming. With average prices reaching $5,000 per month in 2025, many families worry how they’ll afford quality care for their loved one. But financial help is available if you know where to look.

In this article, we break down six practical ways to cover assisted living costs, from veterans' benefits to creative housing solutions. Whether you're planning or need immediate options, these strategies can ease the financial burden and ensure your loved one receives the support they deserve. Peace of mind shouldn’t come with a price tag…

How Do People Pay for Assisted Living?

When seniors can no longer live independently, home care is no longer possible, or if safety issues arise, it may be time to consider moving to an assisted living facility.

Changing their living situation would get your older adult the care they need and make their living space safer.

But the big question is: How does one pay for assisted living? After all, monthly fees can range from $3,000 to more than $10,000 depending on location and amenities.

In this piece, we'll provide six ways to pay for assisted living and explain how to get help planning for major care expenses.

6 Ways to Pay For Assisted Living

1. Utilize Private Savings

- If an older adult has enough savings, they could pay “out of pocket” using personal savings or income.

- Consider speaking with a reputable financial adviser to confirm that your older adult’s savings will last through the years. For a quick ballpark estimate, use this long-term care cost estimator.

2. Sell the House and use the Proceeds

- Some older adults can sell their homes and use the proceeds to cover the costs of assisted living.

- If the house is still on the market but the move to assisted living is needed urgently, a bridge loan could help cover costs until the home is sold. FYI, that’s a short-term loan and could be a risky choice. But it’s something to consider if you’re stuck.

3. Use Long-Term Care Insurance

Long-term care insurance typically covers nursing home care, home-based care, assisted living, and other medical services.

Don’t assume it won’t be affordable – check with a reputable insurance agent. Long-term care premiums are based on many factors, including”

- Age

- Health

- Benefit amount and duration

- When will the company start paying benefits

- Other factors like location

4. Access Veterans' Benefits if Eligible

- In some cases, veterans' benefits can cover assisted living costs.

- To qualify and apply, contact the local Veterans Affairs office

5. Utilize a Reverse Mortgage

- This is a special type of home loan in which long-time homeowners borrow money against the value of their home without having to sell it.

- There are three types of reverse mortgages. Speak with a reputable bank to learn about the risks and benefits.

6. Access Medicare or Medicaid

- For those who qualify, Medicaid pays for long-term assisted living care.

- Medicare doesn’t cover long-term assisted living, but it may cover short-term rehabilitation stays, typically after an inpatient hospital stay.

VIDEO: How to Pay for Assisted Living

Strongly Consider Using an Elder Law Attorney for Help

Paying for assisted living and other long-term care costs can be expensive and complex. That’s why it may be worthwhile to consult an elder law attorney.

An elder law attorney should be able to answer essential questions like:

- Could Dad qualify for Medicaid to cover his care?

- How do we protect Mom’s house and assets, but still afford the care she needs?

- How can we ensure Mom has money left after all of Dad’s care expenses are paid?

These are complex questions, and the answers will vary by state and by situation.

A reputable elder law attorney may be able to help figure out how to afford the care your older adult needs. The lawyer's fees could be well worth it if they could save your older adult a significant amount of money.

Final Thoughts on How to Pay For Assisted Living

Navigating the financial path for assisted living is undoubtedly complex, but it is a journey you don't have to walk alone. By understanding the full spectrum of options (from long-held assets and veterans benefits to creative family arrangements and specialized loans), you can build a sustainable plan.

The right solution often involves combining several of these resources to bridge the gap to the care your loved one deserves. Start the conversations, explore each avenue thoroughly, and seek guidance from financial and senior care advisors.

With proactive planning, you can shift the focus from worrying about cost to ensuring comfort, safety, and a high quality of life in this new chapter.

Recommended for you:

- Financial Help for Seniors: 2,500+ Federal, State, & Private Benefits Programs

- How to Estimate Long Term Care Costs to Make Care Decisions Easier

- 5 Smart Tips for Hiring an Elder Law Attorney

About the Author

Connie is the founder of DailyCaring.com and was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also understands the importance of support, especially in the form of practical solutions, valuable resources, and self-care tips.

Why would you not consider selling your home and annuitizing with that money with a rider that includes any unspent part of the annuitization will go to your children?

Thanks for the suggestion, this might be the right choice for some people, but may not be the right financial move for everyone. We strongly urge people to get an expert opinion from a fiduciary to help make an informed decision that will benefit their finances in the long run.

Unless the person is on the Medicaid Waiver program (in Michigan), Medicaid does not pay for assisted living. It does pay for nursing home care if the person qualifies financially and medically.

There is no discussion of Government Retirements: Civil Service GS-13, Lt Col Res, VA Disability. These retirements are for as long as the USA is in business.

#4 talks about Veteran’s benefits and how in some cases, they may be used to cover assisted living costs. It’s not as common, but it’s possible that other government pensions could include these benefits, but each person would have to look into their specific plan.

Medicaid does not pay for Assisted Living in California. We need a law change soon, because it is a major crisis for elders who have outlived their resources, are frail but not in need of nursing care .

In California, seniors can apply for an Assisted Living Waiver. It would be great to have even more options and protections available for older adults who need care.

Are there 2 types of senior residences—“buy in” and pay monthly out of pocket? I prefer not the former, but the latter. What are some options in my area—Fremont, Ca?

There are a variety of senior living options and it’s best to find out about payment options from the community itself.

We don’t provide any housing services, but these articles may be helpful:

— 7 Senior Housing Options: Which One Fits Best? https://dailycaring.com/senior-housing-options-overview/

— Senior Housing Experts Help Seniors Find the Perfect Place to Live https://dailycaring.com/senior-housing-experts-help-seniors-find-the-perfect-place-to-live/

— A Geriatric Care Manager Advocates for Seniors and Helps Families https://dailycaring.com/how-geriatric-care-manager-can-help-you/

— Handy Checklist and Tips on How to Find a Good Assisted Living Facility https://dailycaring.com/this-checklist-helps-you-choose-the-right-senior-living-facility/