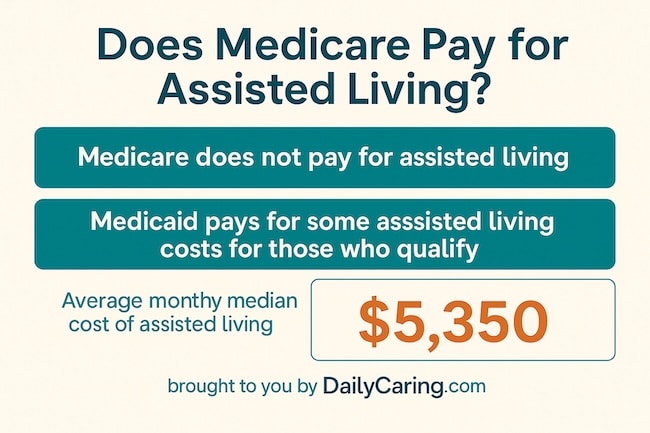

Plenty of people are shocked to find out that Medicare doesn’t cover costs for most types of long-term care, including Alzheimer’s and dementia care.

When it does pay, it’s only in a minimal capacity for older adults with recoverable conditions on a short-term basis. This piece explains why Medicare doesn’t pay for assisted living and what types of long-term care Medicare Advantage covers.

Does Medicare Pay For Assisted Living?

The answer is no. Medicare doesn’t cover the cost of assisted living facilities or other long-term residential care, such as nursing homes or memory care.

That’s because Medicare doesn’t cover the cost of room and board or non-skilled assistance with daily activities (personal care), comprising most assisted living care.

However, whether your older adult lives in their home or an assisted living facility, Medicare will continue to cover prescription medications and/or other medical services that your specific plan would have typically covered.

Why Doesn’t Medicare Cover Assisted Living?

Medicare is designed to cover medical care (like hospital stays, doctor visits, and short-term rehab), not custodial care (help with daily activities like bathing, dressing, or meals). Since assisted living primarily provides custodial care, Medicare won’t pay for:

✔ Room and board

✔ Personal care assistance

✔ Long-term supervision

But there’s a twist: If you need skilled nursing or therapy temporarily, Medicare Part A might cover those services, even if you’re in an assisted living facility.

What Else Does Medicare Cover for Seniors?

While it won’t pay for assisted living, Medicare can help with:

- Short-term skilled nursing care (Part A, up to 100 days after a 3-day hospital stay).

- Home health care (Part A/B, if you’re homebound and need intermittent skilled care).

- Medical equipment or therapy (Part B, like walkers or physical therapy).

- Prescription drugs (Part D or Advantage Plans).

💡 Pro Tip: Use Medicare’s Nursing Home Compare tool to check coverage for skilled nursing facilities.

VIDEO: Does Medicare Cover Assisted Living?

Does Medicare Cover Other Long-Term Care Services?

Medicare may cover long-term care services for short-term stays only under specific circumstances.

Suppose a doctor determines that an older adult needs specialized nursing or rehabilitation after an inpatient hospital stay lasting at least three days. In that case, original Medicare will pay 100% of the cost of care up to 20 days at a Medicare-certified skilled nursing facility and approximately 80% of the cost up to 80 more days.

This coverage begins only if your older adult was formally admitted to a hospital for three days or more, not if they were there under observation.

And this coverage doesn’t apply to assisted living facilities, which don’t provide skilled nursing or intensive medical care.

Does Medicare Advantage Pay for Assisted Living?

Medicare Advantage is required to cover at least as much as Original Medicare.

However, Medicare Advantage doesn’t cover assisted living or long-term residential care.

Medicare Advantage is a private insurance plan contracted through the government, so each policy has specific benefits.

Medicare Advantage typically covers eligible medical expenses like prescriptions, surgery, doctor’s appointments, screenings, and equipment, whether an older adult lives in their home or moves to an assisted living facility.

Medicare Advantage plans may also include additional benefits like transportation to medical appointments, vision and hearing coverage, and gym memberships.

Also, just like Original Medicare, costs may be covered if your older adult needs short-term care at a skilled nursing facility immediately following a hospitalization.

How to Pay for Assisted Living Without Medicare

Since Medicare won’t cover assisted living costs, consider these alternatives:

1. Medicaid

- Covers assisted living in most states via waiver programs (income limits apply).

- Action Step: Check your state’s rules at Medicaid.gov.

2. Veterans' Benefits

- Aid & Attendance benefits help wartime vets and surviving spouses pay for care.

- Action Step: Contact the VA at 1-877-222-VETS (8387).

3. Long-Term Care Insurance

- Policies often cover assisted living (check your plan’s terms).

4. Private Pay Options

- Reverse mortgages, life insurance conversions, or family contributions.

Key Takeaways

✅ Medicare doesn’t pay for assisted living, but may cover medical services.

✅ Medicaid and VA benefits are the top alternatives for financial aid.

✅ Plan ahead: Explore long-term care insurance or hybrid policies early.

Need personalized help? Contact your local State Health Insurance Assistance Program (SHIP) for free Medicare counseling.

Final Thoughts

While the news that Medicare does not cover long-term assisted living costs can be disappointing, understanding this reality is the first step toward building a viable financial plan. This clarity allows you to proactively explore the essential alternatives, such as Medicaid, veterans benefits, long-term care insurance, and other private pay options.

We encourage you to use this information to start conversations with a financial advisor or an elder law attorney, who can help you navigate the best path forward to secure safe, comfortable, and sustainable care for your loved one.

Recommended for you:

- 7 Senior Housing Options: Which One Works Best?

- How to Pay for Assisted Living: 6 Options

- When to Move to Assisted Living? Advice From a Social Worker

About the Author

Connie is the founder of DailyCaring.com and was a hands-on caregiver for her grandmother for 20 years. (Grandma made it to 101 years old!) She knows how challenging, overwhelming, and all-consuming caring for an older adult can be. She also understands the importance of support, especially in the form of practical solutions, valuable resources, and self-care tips.