Caregiver stress can cause serious negative effects on your physical and mental health. One major source of stress is the caregiver's financial burden.

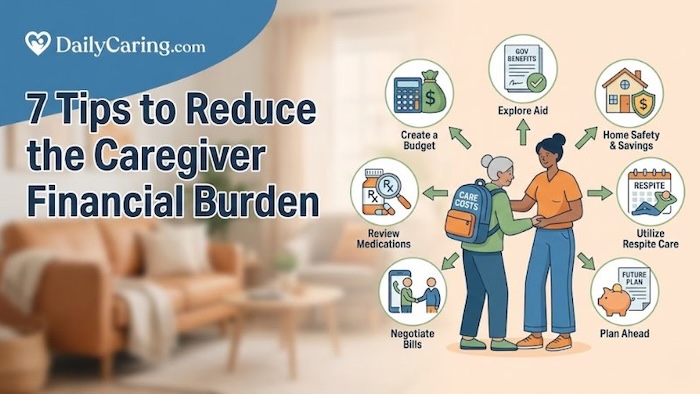

You do what’s necessary to help your loved one get the care they need. But that care often comes at a high cost. To reduce the financial burden, Vive Health shares 7 tips to save on caregiving expenses, which can help decrease stress.

Lost sleep. Back pain. Headaches. Anxiety. Does this sound familiar to you?

Many family caregivers experience negative health symptoms due to the physical and mental demands of caregiving, but the financial burden can have serious effects as well.

A recent survey of 2,000 family caregivers found that 92% are also “financial caregivers” – meaning they provide assistance with their older adult’s financial needs.

2 Money Management Roles Most Caregivers Fill

- Financial coordinators – organize bills, file taxes, coordinate investments, plan budgets, etc.

- Financial contributors – provide money for care, supplies, etc., and pay medical bills out of their own pocket

The survey found that 88% of caregivers take on the financial coordinator role, and 68% take on the financial contributor role. But 64% of family caregivers actually take on both roles.

All in all, caregivers spend an astounding $190 billion a year on the older adults they care for.

Find out about common sources of financial stress and get 7 tips to help reduce costs and take some of the pressure off.

Common sources of financial stress for caregivers

Financial stress can build up in a variety of ways, including:

- Mounting medical bills for doctor’s visits, hospital visits, medical tests, etc.

- Cost of caregiving supplies (e.g., durable medical equipment, incontinence supplies, food)

- Lost wages and missed career advancement, either from leaving a job to care for their older adult or simply having to manage both work and caregiving careers

- Aging adults getting scammed out of their savings

- Mistakes on bills/invoices from healthcare providers that require a lot of time and effort to correct

Chronic stress associated with these types of financial burdens can show up in more ways than just a negative mood.

Symptoms linked to long-term stress include:

- Social isolation

- Depression

- Tension headaches

- Panic attacks

- Increased risk of high blood pressure, stroke, or heart attack

- And more

7 tips for reducing stress when it comes to caregiver finances

To save money and reduce the stress of financial responsibilities, try these 7 tips.

- Save on prescription medications by asking your doctor for free samples, switching to lower-cost generics, or using state programs. You can also ask for the cash price, which is frequently less expensive than insurance options.

- Use all the good deals for older adults that you can find, including senior discounts on groceries, medical supplies, restaurants, hotels, travel, retail, delivery, fitness, and more.

- Buy regularly-used supplies in bulk from wholesale stores like Costco or Sam’s Club – tissues, paper towels, cleansing wipes, adult briefs, incontinence pads, protein shakes, food, etc.

- Check with local non-profit organizations for help with necessary home repairs and upgrades that improve your older adult’s safety and health.

- Search for “lending programs” in your area that allow you to borrow durable medical equipment for free – bath chairs, wheelchairs, canes, etc.

- Encourage family members to gift useful items for your older adult’s birthday, holidays, etc. For example, you could say, “Instead of candles and socks this year, Mom could really use an overbed table for her room. It would make her life much easier and be a constant reminder of your support.”

- Maximize tax deductions over the year by taking advantage of helpful tax tips for caregivers, and get free tax help for seniors from the IRS

Finding clever ways to save money, avoiding common scams, and asking family members, financial planners, or even social workers for financial support and advice can go a long way toward reducing the financial burden you’re feeling as a caregiver.

Final Thoughts on Reducing a Caregiver's Financial Burden

The financial strain of caregiving is a heavy weight, but as these seven strategies demonstrate, it is not a burden you must carry alone. By proactively organizing documents, exploring all available benefits, and fearlessly negotiating costs, you can turn financial overwhelm into a manageable plan.

Remember, every dollar saved and every resource uncovered is an act of care, for your loved one and for yourself. Implementing even a few of these tips can create crucial breathing room, allowing you to focus less on mounting bills and more on the meaningful connection at the heart of your caregiving journey.

Recommended for you:

- How Seniors Can Get Help Paying for Prescription Drugs

- 7 Sources of Home Repair Assistance for Seniors

- 3 Ways of Getting Paid as a Family Caregiver: Government Benefits Programs

Guest contributor: Jessica Hegg is the content manager at ViveHealth.com. Interested in all things related to a healthy lifestyle, she works to share valuable information to help others overcome obstacles and improve their quality of life.

About the Author

Jessica Hegg is a manager at ViveHealth.com. Ms. Hegg was also a full-time caregiver for her Mom who had Primary Progressive MS and Epilepsy. She is a freelance writer with a passion for cooking and lives in Austin, TX with her Mom and her wonderful husband. You can find her personal blog about caregiving tips, ideas, and solutions at Givea.Care.