Navigating skyrocketing prescription drug costs for seniors has long been a source of stress for family caregivers, but the 2026 Medicare Part D changes are finally providing much-needed relief.

With the new Medicare $2,000 out-of-pocket cap now in full effect, many families will see their pharmacy bills vanish once they hit the annual limit. This guide breaks down exactly how to leverage these new federal protections and digital tools to slash your caregiving expenses today.

Significant Medicare Part D Changes for 2026

The landscape of Medicare has shifted significantly this year. If you are managing medications for a senior, these two updates are the most critical to understand when it comes to prescription drug costs for seniors:

The Medicare $2,000 Out-of-Pocket Cap

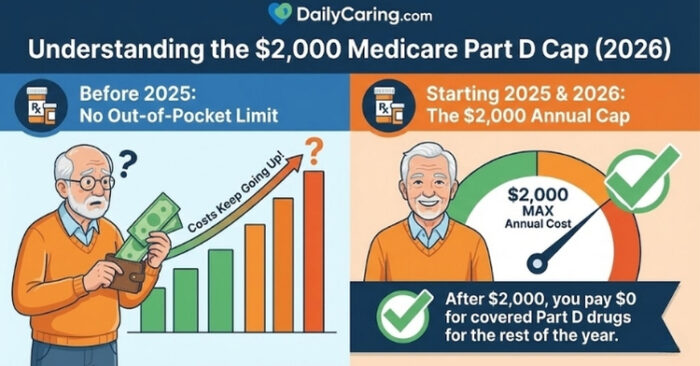

Starting in 2025 and fully established for 2026, there is now a $2,000 annual cap on out-of-pocket costs for covered drugs in Medicare Part D. This means once your loved one spends $2,000 on prescriptions in a calendar year, they will pay $0 for their covered drugs for the remainder of that year.

This is a game-changer for those managing high-cost conditions like cancer, MS, or rheumatoid arthritis.

INFOGRAPHIC: Understanding the $2000 Medicare Part D Cap for 2026

The Medicare Prescription Payment Plan

To prevent caregivers from facing a massive bill at the pharmacy counter in January, Medicare now offers the Medicare Prescription Payment Plan. This voluntary option allows you to spread out-of-pocket drug costs into fixed monthly installments throughout the year, making monthly budgeting for prescription drug costs for seniors much more predictable.

3 Strategic Ways to Reduce Prescription Costs for Seniors Today

Even with the new $2,000 cap, many families still struggle to reach that threshold or deal with drugs not covered by Part D. Here is how to compare your savings options:

Savings Strategy Comparison

| Saving Strategy | Primary Benefit | Best For… |

|---|---|---|

| Discount Coupons | Bypasses insurance to find lower “cash prices” at local pharmacies. | Non-covered drugs or high-deductible plans. |

| Cost-Plus Pharmacies | Offers transparent, low-margin pricing on generic medications. | Chronic generic maintenance meds (Heart, BP). |

| Patient Assistance (PAPs) | Manufacturer programs that provide brand-name drugs for free or near-free. | Expensive brands with no generic equivalent. |

Digital Tools for Immediate Savings on Prescription Drug Costs for Seniors

Before heading to the pharmacy, check these three digital resources to see if you can beat your insurance co-pay:

- GoodRx: Still the most reliable tool for comparing local pharmacy prices and finding instant coupons.

- Mark Cuban Cost Plus Drugs: A direct-to-consumer pharmacy that eliminates the “middleman” markups on hundreds of generics.

- Amazon Pharmacy RxPass: For a flat $5 monthly fee, Prime members can get all their eligible generic prescriptions delivered to their door.

Finding Financial Assistance for Prescriptions

If the $2,000 cap is still out of reach, there are specialized “safety net” programs designed to help:

- Extra Help (LIS): This federal program helps seniors with limited income pay for Medicare drug plan premiums and co-pays. Check eligibility via the Social Security Administration.

- BenefitsCheckUp: The National Council on Aging (NCOA) provides a comprehensive search tool to find state and local programs that help with medication costs.

- State Pharmaceutical Assistance Programs (SPAPs): Many states offer their own pharmaceutical assistance. You can find your local SPAP contact here.

BONUS: How to Talk to the Doctor About Prescription Drug Costs for Seniors

Many caregivers feel uncomfortable bringing up money in a medical setting, but doctors are often unaware of the specific “tier” or cost of the drugs they prescribe. Use these specific phrases to start the conversation:

- The Direct Approach: “We are concerned about the monthly cost of this medication. Is there a therapeutic equivalent or a generic version that would be more affordable?”

- The ‘Tier' Check: “Our Medicare plan has a high co-pay for this specific drug. Can we check if there is an alternative on a lower cost-sharing tier?“

- The Samples & Coupons Ask: “Do you have any manufacturer starter samples or co-pay assistance cards available in the office for this brand?”

- The Cost-Plus Inquiry: “Is this medication available through a transparent-pricing pharmacy like Cost Plus Drugs, and can you send the script there directly?”

Recommended for you:

- How Seniors Can Get Help Paying for Prescription Drugs

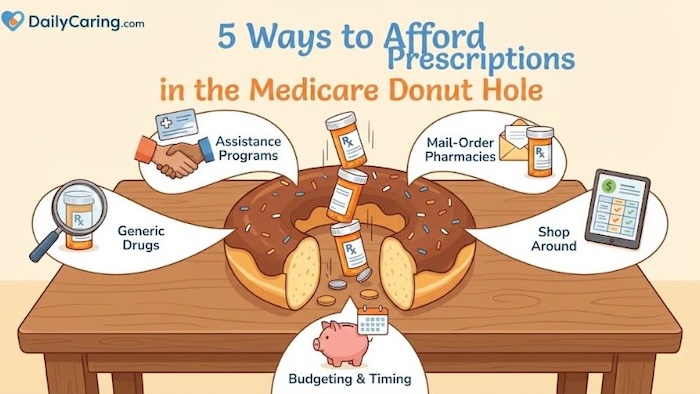

- 5 Ways to Afford Prescriptions in the Medicare Donut Hole

- Benefits Programs Help Pay for Caregiving Expenses

About the Author

Chris is a seasoned healthcare executive and entrepreneur from the Pacific Northwest. He strongly advocates for older adults and the caregivers who serve them. Chris has personal experience caring for his father, who had dementia. Chris is an avid outdoorsman; if he's not in his office, he can usually be found on a golf course or in a garden out west somewhere.