Choosing a Medicare path is one of the most significant financial and health decisions a senior will make. The “best” plan isn't universal—it depends entirely on your budget, your health needs, and how much you value flexibility versus all-in-one convenience.

Find out how Medicare plans work and the differences between Original Medicare and Medicare Advantage.

Option 1: Original Medicare: The “Traditional” Path

Original Medicare is the federal program managed by the government. It offers the most flexibility but requires you to “build” your coverage by adding separate pieces.

- Part A (Hospital Insurance): Usually premium-free, covering hospital stays, hospice, and some home health.

- Part B (Medical Insurance): Covers doctor visits, preventive care, and Durable Medical Equipment (DME). It carries a monthly premium based on income.

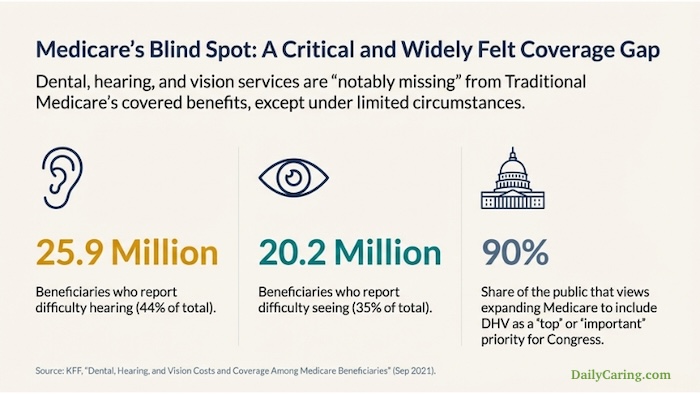

- The “Gaps”: Original Medicare has no annual limit on out-of-pocket costs and generally does not cover dental, vision, or hearing aids.

Medicare's Blind Spot: “The Coverage Gap”

Essential Add-ons for Original Medicare

Because Original Medicare has “gaps,” most people add:

- Medicare Supplement (Medigap): Private insurance that helps pay your share (coinsurance/deductibles) of Medicare-covered costs.

- Part D (Prescription Drug Plans): Standalone plans to cover your medications. Each plan has a “formulary” (list of covered drugs).

VIDEO: Everything You Wanted to Know About “Open Enrollment”

Option 2: Medicare Advantage: The “All-in-One” Path

Medicare Advantage (Part C) is a private insurance alternative to Original Medicare. These plans contract with the government to provide your Part A and Part B benefits.

- Integrated Coverage: Most plans include prescription drug coverage (Part D) and additional benefits such as dental, vision, hearing aid discounts, and fitness memberships.

- Financial Protection: Unlike Original Medicare, these plans have a Maximum Out-of-Pocket (MOOP) limit. Once you hit that limit, the plan pays 100% of covered services for the rest of the year.

- The Trade-off: Most plans use Provider Networks (HMOs or PPOs). If you see a doctor outside the network, you may pay significantly more or have no coverage at all.

Quick Comparison: At a Glance

| Feature | Original Medicare + Medigap | Medicare Advantage (Part C) |

|---|---|---|

| Doctor Choice | Any doctor in the U.S. who accepts Medicare. | Usually limited to a local network of providers. |

| Costs | Higher monthly premiums, but very low/no costs when you see a doctor. | Lower (or $0) monthly premiums, but you pay copays as you go. |

| Prescriptions | Requires a separate Part D plan. | Usually included in the plan. |

| Extras | Generally no dental, vision, or hearing. | Often includes dental, vision, and wellness perks. |

| Referrals | Usually not required to see a specialist. | Often required (depending on the plan type). |

How to Decide Between Original Medicare and Medicare Advantage

Choose Original Medicare if:

- You travel frequently within the U.S. or want the freedom to see any specialist.

- You prefer a predictable monthly budget (paying a premium to avoid “surprise” bills later).

- You have a chronic condition that requires frequent specialist visits.

Choose Medicare Advantage if:

- You want lower monthly premiums and don't mind paying copays for services.

- You want the convenience of an “all-in-one” card for medical and drugs.

- You value the “extras” such as gym memberships and basic dental/vision coverage.

A Note on Quality: When researching, be sure to check the “Star Ratings” for plans in your area. Recently, some large insurers have come under scrutiny for access to medically necessary care. Always verify that your must-have doctors and medications are covered before enrolling.

BONUS: A Medicare Broker Interview Checklist

Part 1: Vetting the Broker’s Transparency

Before discussing specific plans, understand who the broker represents and how they are compensated.

- “How many insurance companies do you represent in my area?” (A captive agent only sells for one company, while an independent broker should represent multiple.)

- “Do you offer every Medicare Advantage and Part D plan available in my zip code?” (Most don't; they are required to tell you if they don't offer every plan.)

- “How are you paid for this enrollment?” (Brokers typically receive a commission from the insurer; ensure they aren't steering you toward a plan just for a higher payout.)

- “What support do you provide after I sign up?” (Ask if they help with billing issues or annual reviews when plans change.)

Part 2: Checking Your “Must-Haves”

Medicare plans change their networks and drug lists (formularies) every year.

- “Are my specific doctors, specialists, and preferred hospitals in this plan's network?”

- “Are all my current medications on the plan’s 2026 formulary, and what are the copay tiers for each?”

- “Does the plan require ‘Prior Authorization' or ‘Step Therapy' for any of my medications or treatments?”

- “Is my preferred pharmacy ‘preferred' in this network to get the lowest price?”

Part 3: Managing Costs and “Hidden” Details

A $0 premium doesn't mean the plan is free.

- “What is the Maximum Out-of-Pocket (MOOP) limit for this year?”

- “What are the specific copays for the services I use most (e.g., physical therapy, specialist visits, or lab work)?”

- “Does this plan cover me if I travel outside the state or the country?”

- “Do I need a referral from a primary doctor to see a specialist?”

Part 4: Evaluating the “Extras”

Perks can be valuable, but only if they are accessible to you.

- “Is the dental coverage ‘comprehensive' (covers crowns/root canals) or just ‘preventive' (cleanings only)?”

- “What are the specific limits or ‘allowances' for vision and hearing aids?“

- “Is there a local gym in my neighborhood that accepts the plan's fitness benefit (e.g., SilverSneakers)?”

🚩 Red Flags: When to Walk Away

Be alert for these warning signs during your 2026 enrollment:

- Unsolicited Calls: If an agent calls you out of the blue claiming to be from “Medicare” or “the enrollment department,” it is likely a scam. Real agents cannot cold-call you without permission.

- The “Chip Card” Lie: There is no new “Medicare chip card” for 2026. Anyone asking for your Medicare number to “verify” your card is a fraudster.

- High Pressure: If an agent says you “must decide today” or uses 2026 updates as a scare tactic, walk away. Legitimate agents give you time to think.

- Skipping the Paperwork: An agent must have you sign a Scope of Appointment (SOA) form before discussing specific plans. This protects you by documenting exactly what they are allowed to sell you.

Recommended for you:

- Medicare Open Enrollment 2023: Minimize Costs, Maximize Coverage

- Get Medicare Advice From State Counseling Programs

- Medicare vs. Medicaid: What You Need to Know

Guest contributor: Alice Stevens has managed the health and life insurance content for Best Company since 2018. She’s passionate about conducting promising research and understanding the details you need to know about insurance.

I would like to know how I can save on my prescription drugs. Also I would like to know how to pay for medical marijuana.

We aren’t familiar with programs that pay for medical marijuana, so you may want to contact your insurance company to find out more.

These articles include tips on how to save on prescription medications:

– 7 Ways for Seniors to Reduce the Cost of Prescription Drugs https://dailycaring.com/7-ways-to-save-money-on-prescription-drugs/

– 5 Options for Medications Not Covered by Medicare https://dailycaring.com/5-steps-to-take-when-medications-are-not-covered-by-medicare/

– 5 Ways to Afford Prescriptions in the Medicare Donut Hole https://dailycaring.com/5-ways-to-afford-prescriptions-in-the-medicare-donut-hole/

– Why Seniors Should Ask Pharmacists: How Much Will My Prescription Cost without Insurance? https://dailycaring.com/why-seniors-should-ask-pharmacists-how-much-will-my-prescription-cost-without-insurance/

– The High Cost of Prescription Drugs in America: 3 Medicare Initiatives & 3 Ways to Reduce Costs Now https://dailycaring.com/the-high-cost-of-prescription-drugs-in-america-3-medicare-initiatives-3-ways-to-reduce-costs-now/