For most seniors, the routine at the pharmacy is automatic: hand over your Medicare Part D or private insurance card, wait for the pharmacist to run it through the system, and pay the assigned copay.

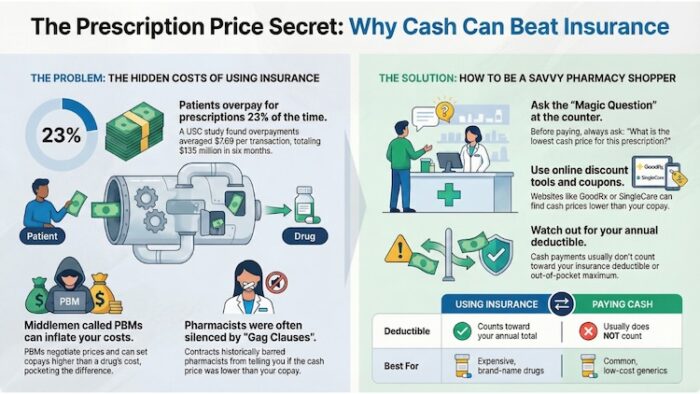

We operate on a fundamental assumption: because we pay for health insurance, using that insurance must secure us the lowest possible price. However, a frustrating truth has emerged in the modern pharmaceutical industry: Your insurance copay is not always the lowest price.

Why is the Cash Cheaper Than Insurance?

It seems counterintuitive, but the explanation lies in the complex world of Pharmacy Benefit Managers (PBMs). These middlemen negotiate prices between insurance companies and pharmacies.

Sometimes, a PBM sets a “flat” copay for a drug tier (e.g., $20 for all Tier 1 generics). If the actual cost of the drug is only $6, the insurance company or PBM may pocket the difference – a practice often referred to as a “clawback.” By paying the cash price, you bypass this hidden fee.

The “Gag Clause” is Gone, But You Still Have to Ask

Until recently, many pharmacists were legally barred from telling you that a drug was cheaper if paid in cash because of “gag clauses” in their contracts. While the Know the Lowest Price Act banned these practices for Medicare and private plans, pharmacists are still incredibly busy.

They generally won’t volunteer the cash price unless you initiate the conversation.

INFOGRAPHIC: Ask for the Pharmacy's Cash Price So You Can Compare

How to Save: A Step-by-Step Guide

1. The Magic Question: Before the pharmacist rings you up, ask: “What is the pharmacy’s lowest cash price for this prescription compared to my insurance copay?”

2. Check Discount Tools: Use reputable tools like GoodRx or SingleCare to see the “market” cash price in your zip code.

3. Inquire About “House” Programs: Many large retailers, like Walmart or Costco, have their own low-cost generic lists that can be cheaper than any insurance plan.

VIDEO: ALWAYS Ask For the Cash Price At Your Pharmacy!

The Vital Caveat: Deductibles and “Out-of-Pocket Max”

Before you choose the lower cash price, consider your Medicare Part D “Donut Hole” and annual deductible.

- When Cash Is Smart: If you take low-cost generics and rarely reach your annual deductible, paying $8 cash instead of a $20 copay is an immediate win.

- When Cash Is Risky: When you pay cash outside of your insurance, that money typically does not count toward your deductible or out-of-pocket maximum. If you have high medical expenses and expect to reach your catastrophic coverage phase, it may be better to pay the higher copay so the expense is counted toward your plan's catastrophic coverage.

Summary Table: Cash vs. Insurance for Prescription Medications

| Factor | Using Insurance | Paying Cash |

|---|---|---|

| Price | Fixed Copay | Market/Retail Price |

| Deductible | Counts toward total | Usually does NOT count |

| Paperwork | Automatic | None (unless self-submitting) |

| Best For | Expensive Brand Names | Common Generics |

Other Considerations When Shopping for Prescription Medications

1. The Safety Warning: Don't Lose Your Safety Net

While “pharmacy hopping” to find the best cash price can save you money, it also carries significant health risks. When you use one pharmacy and one insurance card, the pharmacy's computer system automatically checks for dangerous drug interactions.

If you buy some meds with insurance at a big chain and others with cash at a local independent pharmacy, that “safety net” disappears.

- The Fix: Always keep a master medication log for safety. *see below

- The Action: Every time you fill a cash-price script, tell the pharmacist: “I also take [Drug X] and [Drug Y] filled elsewhere. Can you quickly check for interactions with this new one?”

Free Master Medication Log

Master Medication & Pharmacy Log

Show this to the pharmacist whenever you fill a new prescription.

| Medication Name | Dosage & Freq. | Pharmacy Used | Notes (e.g., Price) |

|---|---|---|---|

*Keeping this list updated helps prevent dangerous interactions when using multiple pharmacies.

2. Check for Patient Assistance Programs (PAPs)

If a drug is brand-name and expensive, the “cash price” might still be out of reach. In these cases, look for Patient Assistance Programs. These are programs run by drug manufacturers specifically for people who cannot afford their medications.

- You can search for these programs on sites like MedicineAssistanceTool.org or NeedyMeds.

- Many of these programs provide the medication for free or a very small flat fee if you meet their income requirements.

3. The Power of Independent Pharmacies

Don't assume the big-box chains always have the best deals. Independent, locally owned pharmacies often have greater pricing flexibility.

- Therapeutic Alternatives: A local pharmacist may have the time to suggest a “therapeutic alternative”—a similar drug that is much cheaper. They can then call your doctor to see if a switch is appropriate for your health.

- Personal Service: Independents are often more willing to help you navigate the “cash vs. insurance” math because they aren't tied to corporate PBM contracts in the same restrictive way.

4. Pro-Tip: Use the Medicare Plan Finder

If you are on Medicare, the cash price is a great “quick fix,” but your long-term strategy should happen during Open Enrollment (October 15 – December 7).

- Use the official Medicare Plan Finder to input your specific list of medications.

- The tool will calculate the total cost (monthly premiums + your specific copays) for every plan in your area. Sometimes, a plan with a slightly higher monthly premium ends up being much cheaper overall because it covers your specific meds at a lower tier.

Printable Reminder Checklist to Take to Your Pharmacist

Pharmacy Savings Checklist

Take this to the counter for every prescription

The Bottom Line

Being a savvy pharmacy shopper isn't just about saving a few dollars; it's about making sure your healthcare budget lasts as long as you do. By asking the right questions, checking for manufacturer assistance, and using the Medicare tools available to you, you can take control of your prescription costs.

VIDEO: 10 Medications That Can Cause Falls in Aging Adults

Recommended for you:

- 7 Ways for Seniors to Reduce Prescription Drug Costs

- 5 Ways to Afford Prescriptions in the Medicare Donut Hole

- 14 Questions to Ask Doctors When Starting New Medications for Seniors

About the Author

Chris is a seasoned healthcare executive and entrepreneur from the Pacific Northwest. He strongly advocates for older adults and the caregivers who serve them. Chris has personal experience caring for his father, who had dementia. Chris is an avid outdoorsman; if he's not in his office, he can usually be found on a golf course or in a garden out west somewhere.

I’m in a Medicare Advantage plan (awesome!) so drug coverage is part of my plan. Of course, there are restrictions on which drugs the plan covers and doesn’t. Not a problem for me, I know generics are the most cost effective, when available. And even so, plans don’t always cover all generics.

When price comparing my Rx, the Costo pharmacist helpfully pointed out that they could fill a 180 or 360 day rx for the same price as a 90 day. Which turned out to be cheaper than running the rx through insurance. My doc was willing to write the rx for 360, since I’d been on the same generic for years without issue. I fill the rx for a year at a very reasonable cash price, and get reimbursed from my retiree HRA that my former employer provides. No mail order refills to remember, no multiple trips to the pharmacy, sometimes easier and cheaper to pay cash for a larger quantity rx if that works for you. But check your pricing both ways, because things can change.

It’s wonderful that you’re happy with your health insurance plan! And fantastic that you’ve been able to get such a great deal on your prescription medication and the added convenience of only picking up a prescription once a year! Speaking with the pharmacist about the options available and working with your doctor to get the necessary prescription was well worth it for you 🙂 Thank you for sharing your experience.