Assisted living and nursing home costs have reached record highs in 2026, with the national average for a semi-private room now exceeding $115,000 per year.

For most aging adults, Medicaid is the only viable way to cover these staggering costs. However, many find themselves in the “eligibility gap”: they have too much money to qualify but not enough to pay for care out of pocket.

This is where a Medicaid spend down becomes a vital financial tool. By strategically reducing countable assets, seniors can meet strict eligibility requirements without simply “losing” their hard-earned savings.

1. The 2026 Financial Landscape: Asset & Income Limits

In 2026, most states maintain an individual asset limit of $2,000, though notable exceptions include California and New York, which have higher thresholds. However, it is a common misconception that you must sell your home to qualify.

For 2026, the Medicaid Home Equity Interest Limit has been adjusted to $752,000 in most states, and as high as $1,130,000 in high-cost areas like New York or Massachusetts. If your equity falls below this level and you (or a spouse) intend to live there, the home is typically exempt from the “spend down” requirement.

2. Approved Ways to Spend Down Assets

You cannot simply give money away to family members; doing so triggers the 60-month look-back period (30 months in California), resulting in stiff penalties. Instead, the Centers for Medicare & Medicaid Services (CMS) allows spending on:

- Home Improvements: Installing ramps, grab bars, or a new roof on a primary residence (which is often an exempt asset).

- Medical Equipment: Purchasing medical equipment not covered by insurance, such as advanced hearing aids or specialized wheelchairs.

- Debt Liquidation: Paying off mortgages, car loans, or credit card balances.

- Prepaid Funerals: Establishing an irrevocable funeral trust to cover end-of-life costs.

VIDEO: What is the Medicaid Look Back Period?

Before you begin spending down, it is critical to understand the ‘look-back' rules. Watch this brief explanation of how Medicaid audits your last five years of finances to avoid accidental penalties.

Bonus VIDEO: A Deep-Dive for California Readers

Elder law expert Kirsten Howe explains why California is “moving back to asset limits” in 2026 (the $130,000 threshold) and how to use irrevocable trusts effectively.

3. Protecting the “Healthy Spouse”

For married couples, the 2026 federal guidelines provide critical protections to prevent “spousal impoverishment.” The Community Spouse Resource Allowance (CSRA) allows the spouse remaining at home to retain up to $162,660 in jointly held assets.

Additionally, if the healthy spouse’s independent income is low, they may be entitled to a Monthly Maintenance Needs Allowance (MMMNA) of up to $4,066.50 from the applicant's income. This ensures that while one spouse receives care, the other can maintain their standard of living and remain in their community.

Common Mistakes to Avoid

- Gifting Assets: Even small cash gifts to grandchildren can trigger a Medicaid penalty period.

- DIY Planning: Recent 2026 legislative shifts (such as the reimplementation of asset limits in some states) make the rules more volatile. Consulting an elder law attorney is no longer optional—it is a necessity to protect your estate.

2026 Long-Term Care Cost Reference

| Type of Care (National Median) | Avg. Monthly (2026) | Projected Annual | Est. Annual Increase |

|---|---|---|---|

| Nursing Home (Semi-Private) | $9,945 | $119,340 | 7.0% |

| Assisted Living Community | $6,313 | $75,756 | 10.0% |

| Home Health Aide (40 hrs/wk) | $6,878 | $82,536 | 4.9% |

| Adult Day Care | $2,167 | $26,000 | 5.0% |

2026 Medicaid Eligibility: State-by-State Comparison

Next Steps: Your 2026 Medicaid Spend Down Checklist

Planning for long-term care is a complex, high-stakes process. If you are preparing to qualify for Medicaid in 2026, use this checklist to stay organized and protect your assets legally.

✓ Medicaid Planning Action Plan (2026)

- ☐ Audit Countable Assets: Review all bank accounts, stocks, and secondary properties to see how far you are from your state’s 2026 limit.

- ☐ Identify Exempt Assets: Ensure your primary home (up to the $752k–$1.13M limit), one vehicle, and personal effects are properly categorized.

- ☐ Document “Fair Market Value” Spending: Keep every receipt for home modifications or medical equipment to prove to Medicaid that you didn't simply “give money away.”

- ☐ Establish an Irrevocable Funeral Trust: This is one of the safest ways to spend down assets while providing peace of mind for end-of-life costs.

- ☐ Consult a Specialist: Because rules for 2026 have shifted (especially in CA and NY), speak with an elder law attorney before making any transfers.

Final Thoughts on the Medicaid Spend Down Rules for Seniors

The 2026 landscape for long-term care is more expensive than ever, but the “spend down” process doesn't have to mean financial ruin. By understanding your state's specific limits and using approved spending methods, you can secure the care you need while protecting the financial legacy you’ve built.

Medicaid Spend Down: Frequently Asked Questions (2026)

What is the Medicaid look-back period in 2026?

For most states, the Medicaid look-back period is 60 months (5 years). During this time, any assets gifted or sold for less than fair market value can trigger a penalty period. In California, a shorter 30-month look-back applies to certain long-term care services.

Can I spend down my assets by paying off debt?

Yes. Paying off valid personal debts—such as a mortgage, car loan, or credit card balance—is an allowable way to reduce your countable assets without violating Medicaid's strict gifting rules.

Does my primary home count toward the asset limit?

Generally, no. As long as you or your spouse intend to live in the home, it is considered an exempt asset. However, your equity must not exceed the 2026 limit, which is typically $752,000 (or up to $1,130,000 in high-cost states like NY or MA).

What is the Spousal Protection (CSRA) limit for 2026?

The Community Spouse Resource Allowance (CSRA) protects the spouse remaining at home. In 2026, many states allow the healthy spouse to keep up to $162,660 in joint assets to prevent financial hardship.

Recommended for you:

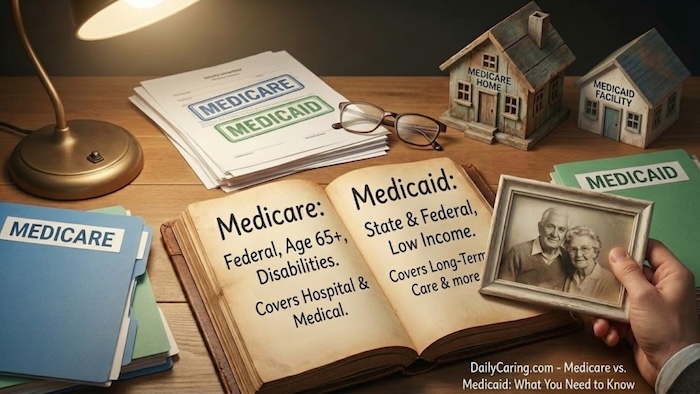

- Medicare vs. Medicaid: What You Need to Know

- How an Elder Law Attorney Can Help Seniors and Caregivers

- Medicaid May Reclaim Money from Your Senior’s Estate

About the Author

Chris is a seasoned healthcare executive and entrepreneur from the Pacific Northwest. He strongly advocates for older adults and the caregivers who serve them. Chris has personal experience caring for his father, who had dementia. Chris is an avid outdoorsman; if he's not in his office, he can usually be found on a golf course or in a garden out west somewhere.